Wiser: Getting Beyond Groupthink to Make Groups Smarter

By Cass Sunstein and Reid Hastie | Harvard Business Review Press | $34.99

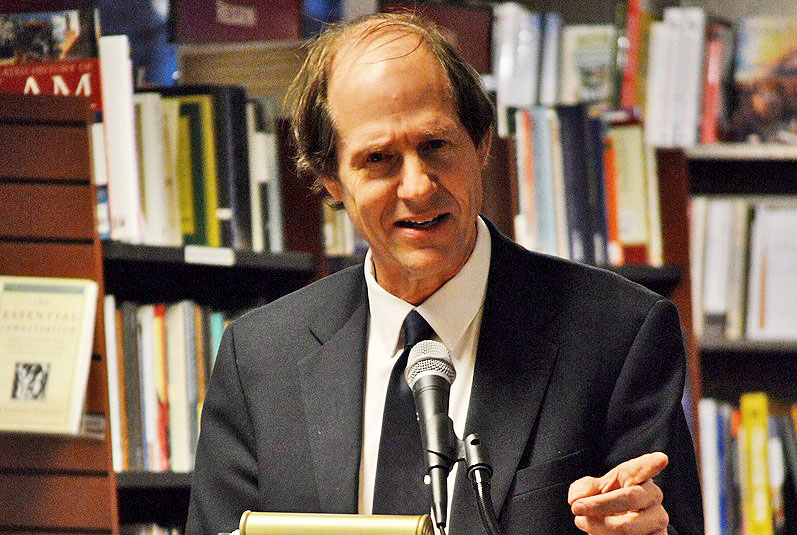

Cass Sunstein is a hyper-productive polyglot American legal scholar who crossed the line from academia into government during the early years of the Obama presidency. There, he headed up the Office of Information and Regulatory Affairs, or OIRA, a division of the White House’s powerful Office of Management and Budget. OIRA reviews federal regulations to ensure relevant agencies appraise draft rules and avoid inconsistent, incompatible or duplicative policies. It also encourages review of existing regulations to promote an efficient regulatory system that keeps pace with modern technology and the changing needs of society. In other words, Sunstein was asked to bring his phenomenal brain to the challenge of making sure that any new regulation issued by the US government helps rather than hinders, is “smart” rather than dumb.

After stepping down from the role, Sunstein characteristically wrote not one but two books about his experience on the inside, and about the work of OIRA in particular. Both sing the praises of a government that makes decisions, regulatory or otherwise, based on “evidence” rather than ideology or intuition.

Sunstein is an unapologetic technocrat committed to making our lives better, and our societies more just, by infusing government with the rigour of evidence-based policy. He advocates systematically applying techniques like cost-benefit analysis, but most of all he insists public policy-makers should learn to respect the evidence he prefers, namely the fruits of what he likes to call “cutting-edge research in behavioural economics.” His 2008 book Nudge: Improving Decisions About Health, Wealth and Happiness (co-written by Richard Thaler) made the case in a language non-specialists could understand, applying it to personal, business and political choices. It argued that since we now know the many unconscious biases and errors that affect people’s choice propensities, we should turn that knowledge to our advantage by pre-designing the choices they face through verbal and visual cues so that they are semi-spontaneously “nudged” away from unhelpful choices and towards “wiser” ones.

His return to academia has seen him publishing another spate of books, of which Wiser is the latest. In it, he and co-author Reid Hastie tackle a complicating factor in Sunstein’s brave new world of evidence-based policy: the fact that most corporate and government decisions are not made by individuals but by groups. The kind of psychological research on human choice he has done much to popularise – by rebadging it as Behavioural Economics and explaining it in crisper language than its original authors had done – pertains overwhelmingly to individuals. But in the White House he entered a world where much of the action takes place in small group settings – committees, teams, taskforces, councils and cliques – and Wiser partly reflects that experience. Sunstein and Hastie ask whether the classic premise that groups are better at performing complex judgement tasks than individuals is actually true. Predictably – decades of social psychological and management research have been showing this emphatically – the answer is no, certainly not all of the time. Groups don’t necessarily correct the limited information-processing capacities and the propensity for bias and error that beset individuals. In fact, they often augment them.

The first half of Wiser explains why. First, rather than harnessing their members’ collective capacities, groups actually amplify the tendency to rely on cognitively efficient but substantively error-inducing biases in assessing situations and reaching judgements. Second, groups can act as “herds,” uncritically following the not necessarily well-informed and non-partisan lead of their most senior, most talkative, most authoritative members. Third, group deliberation often “polarises” group members: they hold more extreme views further along a particular line of thought to which they were already inclined before discussing the issue in the group. And finally, groups have a propensity for relying on information that is already shared between the group members (“Everybody knows that…”), unwittingly crowding out information that only some group members possess, and which may well be critical to a more balanced consideration of the issues.

The writing is brisk, and much of the research presented has been the staple of experts in this field for decades. At the end of part one, the reader feels better equipped to appreciate the logic behind the common quip that a camel is a horse designed by a committee. The authors then rightly sidestep the all-too-easy inference that we therefore should reduce our reliance on groups as forums for designing, planning and policy-making. Instead, they provide us with a range of ideas on how to prevent unproductive group dynamics detracting from the collective intelligence that members of teams, committees, boards and cabinets potentially possess.

The common denominator of all these ideas is that groups do much better when their diversity is harnessed and their members feel empowered to think and speak their minds freely. Diversity as a necessary pathway to collective open-mindedness is especially important in what the authors call the identification stage of problem-solving, which is all about searching, refining or even inventing possible solutions to the issue at hand. During the selection stage, the other main component of problem solving, the emphasis shifts to methodical assessment and critical evaluation of the options in the light of the criteria the group has decided are essential. Rigour during selection is important, but open-mindedness and creativity during identification are essential, we are told, because in group problem solving it is “garbage in, garbage out”: even the most methodical selection process will produce bad results if the only options on the table are narrow, dull, ill-considered, dangerous or otherwise sub-standard.

There are two ways to create and harness diversity during the identification stage. On the one hand, we can do much by purposefully composing groups and managing their deliberation processes. Sunstein and Hastie run through a range of again well-known suggestions. Cherish independent-minded, weary thinkers and don’t socialise them into becoming archetypical “team players,” whose inclination to get along by going along produces the self-censorship that prevents information and expertise only they possess from becoming shared by the group. Allow – indeed encourage – these thinkers to act as devil’s advocates, challenging an emerging group consensus on the basis of their professional instincts and norms. Don’t surrender the work of making highly consequential plans and choices to a single team; engage “red teams” specifically tasked to “take apart” the original team’s work, probe its assumptions, question its analysis. Reconsider what it means to be a good leader in a team setting. Articulating the vision, providing the direction, and other familiar tropes of strong leadership are actually quite unhelpful to get the best out of a group. Instead, leaders should consider the virtues of remaining silent, holding their cards close to their chest, so as to reduce what the authors call the “reputational costs” that group members may incur when they speak up.

All of these suggestions are sensible, and there is much pertinent research in social psychology and management studies about when and how they can be applied usefully. But there is also caution about their feasibility in real-world settings – where things like group composition and leadership style are not simply “variables” to be manipulated for the benefit of better-quality deliberation – and Sunstein and Hastie ignore much of it. They seem keener to sell a second, more innovative path to improving group choices: relying on the law of large numbers and the power of competition. The last few chapters in the book are devoted to presenting evidence from laboratory experiments and from case studies that shows such practices operating in innovative or otherwise successful companies.

How can groups be smarter if they don’t deliberate? Well, they can do it if we’re not talking about small face-to-face groups but about large, statistically significant groups. Here, we enter the world of the much-vaunted “wisdom of the crowd.” Wiser does a good job of explaining its scientific underpinnings but is rightly cautious about throwing every thorny issue out to a large survey or some equivalent consultation procedure. When big groups are not diverse then crowd-based decision-making is still prone to all the biases described in the first part of the book. Sunstein and Hastie argue that we can do better than that.

First, they would seek power in numbers when it comes to enlisting the help of experts. All too often, corporate and political teams will try to get in “the top expert” on issue A or B when they are grappling with a particular form of uncertainty regarding A or B. But recent research by University of Pennsylvania psychologist Philip Tetlock has demonstrated beyond doubt that experts’ predictive abilities are hardly any better than everybody else’s. They are prone to many of the same cognitive heuristics and biases that cloud all our judgements. Yet we can still benefit from the distinctive experiential, theoretical or memory-based knowledge they possess in developing, considering and vetting options. And so Sunstein and Hastie urge us to break through expert monopolies and go for large(r) numbers – to recruit multiple experts to present their diagnoses and recommendations to the group, rather than surrendering to the siren song of only one. These experts’ biases will cancel each other out, but their distinctive bits of knowledge will add up.

Also, Sunstein and Hastie would bank on people’s competitive and profit-maximising instincts. On competition, they cite the famous example of Netflix advertising a $1 million prize for the first algorithm to beat its existing movie recommendation service Cinemath. Within four days of opening up the competition they received a solution that delivered a 10 per cent reduction in the rate of erroneous recommendations. Instead of taking it, they let the competition run for three years. Twenty thousand teams from more than 150 nations participated: not a bad yield for a mere million dollars worth of R&D money. The tournament ensured super-variety in identification, and the explicit criteria articulated in advance by the Netflix organisers ensured efficient selection. Darwin would be content. Others followed suit, including General Electric and the Pentagon, and Obama’s White House joined in with its Challenge.gov program and legal authorisation for public agencies to hold innovation-oriented competitions.

The profit motive was put to work by Google when it created a prediction market. Employees could place “bets” about a variety of matters of key importance to the company: when products would launch, their sales, their success. The bets (investments, in reality) set a price. So if many employees believed that a particular product would sell X units in the coming year and they bet accordingly, the price would reflect that belief. The results were stunningly accurate, Sunstein and Hastie report. The same goes for political prediction markets, where people bet on election outcomes. Pollsters and pundits, move over; here comes the power of the market! And if you want to know the names of the next Oscar winners, take a look at the Hollywood Stock Exchange, which uses virtual money and still gets it right almost all of the time. Citing Hayek, Sunstein and Hastie explain that the key to the accuracy of prediction markets is that because “participants stand to gain or lose from their investments” they have a strong incentive to seek out new and accurate information about the subject at hand, to use it in their decision-making and thus to (indirectly) reveal whatever private information they hold.

So, despite the litany of errors the book began by describing, it ends on a distinctly optimistic note: “The good news is that decades of empirical work, alongside recent innovations, offer a toolbox of practical safeguards, correctives, and enhancements.” I am not so sure. It strikes me as wishful thinking by technocrats. To be sure, there is some ground for enthusiasm about prediction markets and innovation tournaments. But there is reason for caution, too.

Consider a rather self-indulgent example in the book. Sunstein and Hastie boast about the title of their book being the product of a tournament, and how creative it all was. The full title of the book is: Wiser: Getting Beyond Groupthink to Make Groups Smarter. There are four problems with presenting this as a great outcome of a non-deliberative, large-group competitive process. First, it may be just a matter of aesthetics, but I wonder how many people really feel this subtitle is pleasing to the eye or the ear. Second, the authors are quick to dismiss the notion of groupthink (originally defined as premature and excessive concurrence-seeking by members of highly cohesive and/or directively led advisory or decision groups), advanced by psychologist Irving Janis in 1972, and yet they allow the famous concept to emerge in the book’s title in a way that suggests it is real. How else can one go “beyond” it in “making groups smarter”?

Third, one does not need to be a philosopher to grasp that “wiser” and “smarter” are two very different things, yet in this book title they are treated as functional equivalents. Finally, apparently no one in the tournament identified that there is already a book in the same subject area with much the same title (1997’s Beyond Groupthink: Political Group Dynamics and Foreign Policy-making, of which I happen to be one of the co-editors) – or perhaps the authors chose to ignore that book, whose title and contents are all about going “beyond groupthink” in studying, designing and managing small groups in politics. So much for the authors’ oft-repeated stricture that we need to “respect evidence.” In short, despite being the product of the kind of large-numbers tournament the authors place so much hope in, this book title still feels like a horse designed by a committee.

More importantly, in the real world of corporate and public policy-making, face-to-face, deliberating groups are here to stay. And the way they operate is unlikely to yield anytime soon to the sensible, “evidence-based” rigour that Sunstein and Hastie would like to see be brought to bear. The elephants in the room in Wiser are power, politics, professional cultures, psychological needs and institutional interests. These, rather than Sunstein and Hastie’s preferred pursuit of rigorous, evidence-based policy, are what create the motives, incentive structures and behavioural propensities of members of real-world elite groups – and thus are pivotal in shaping their strengths and weaknesses. Janis’s work on groupthink, and the more than four decades of political-psychological research it inspired, demonstrated an acute awareness of this. Those researchers factored these things into their research designs as best they could. In contrast, Sunstein and Hastie like the methodologically robust but often simplistic and sterile scripts of experimental studies in which these “complications” have no place.

They also know the cognitive psychology that is at the heart of behavioural economics inside and out, but they clearly have not delved in any significant way into recent social psychological research on groups, teamwork and intergroup relations. And so they factor all of these things out, thus largely ignoring these much more complex motivational and institutional realities. The result is a book that reads well, repackages old but still worthwhile insights about group problem solving, and offers us a glimpse of new, technology-enhanced ways of collective problem solving. But it simply misses the mark for anyone who is serious about making the governments, corporations and boards that we actually have (rather than the ones the authors want us to have) work better than they often do. •