The claim that Australia has gone twenty-six years without a recession is true, but only if you accept three assumptions. Unfortunately, none of them has any official or intellectual basis.

The first is that a recession is best defined by a single measure: the total output of the economy, which we call gross domestic product, or GDP.

The second is that if GDP goes backwards for two consecutive quarters, however slightly, then you’re in recession. And if it doesn’t, you’re not.

The third is that the correct measure for GDP is the seasonally adjusted figure the Australian Bureau of Statistics releases each quarter – even though the Bureau tells us to focus on its trend measure.

The first assumption is shallow, the second silly, and the third is plain wrong.

If you’re not an economist, you might be surprised to know that economics has no accepted definition of a recession. It’s derived from the verb “to recede” – in other words, to go backwards. But in what ways? And how much? That has never been defined in a way that the profession as a whole accepts.

In public debate, the gap has been filled by the silly measure journalists love to use: a recession occurs when seasonally adjusted GDP goes backwards for two quarters. Greg Jericho in the Guardian has done an excellent job of shredding this simplistic fallacy, which really deserves to be banished from public debate.

Just to take three examples from Australia’s modern history:

1974: On the two-consecutive-quarters rule, Australia didn’t have a recession in 1974, even though everyone could see it happening around them. Seasonally adjusted GDP grew by 0.01 per cent in the March quarter, fell by 2.1 per cent in June, clawed back 1.3 per cent in September, and then rose by 0.03 per cent in December. Sure, by the end of 1974 our output had fallen 0.8 per cent from a year earlier, shops and factories had shut down in their hundreds, and unemployment had almost doubled, but we didn’t have two consecutive quarterly falls. So there was no recession!

1990–91: Remember that? Well, on the two-consecutive-quarters measure, we barely had a recession at all. Seasonally adjusted GDP fell in December 1989, rose in March 1990, just edged up in June, fell in September, rose again in December, fell again in March 1991 – and then it just edged down in June 1991, to give us a second quarter of negative growth. But that fall in June 1991 was tiny – 0.1 per cent – and at one point the Bureau revised it away entirely.

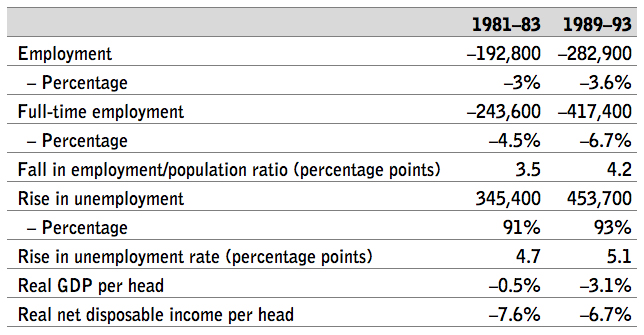

If it hadn’t subsequently revised it back in, there wouldn’t have been a recession at all on this definition. Yet we lost 417,400 full-time jobs, unemployment rose by 453,700 and reached 11 per cent at its peak, and real net disposable income per head fell by 6.7 per cent. That was clearly a recession. Yet on the two-consecutive-quarters measure, it was only a borderline one.

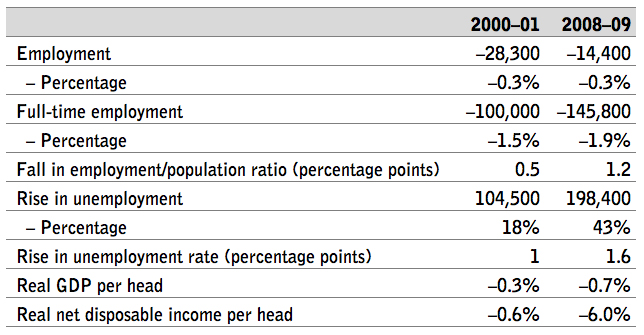

2000: The downturn when the GST came in was really just a speed bump compared to what happened a decade earlier, but on this measure it was a fingertip away from being a full-blown recession. Seasonally adjusted GDP rose just 0.04 per cent in September 2000, then fell 0.24 per cent in December. That September growth could well be revised away some day, which on this definition would make it a recession. That would spoil our record twenty-six years without one, wouldn’t it?

These were severe recessions…

But were these milder ones?

So what better measures are there? The National Bureau of Economic Research in Washington has the best approach. It appoints a panel of eight of the country’s finest macroeconomists, all from universities, and lets them decide when they think a recession began and ended. (For the record, they think the US had an eight-month recession in 2001, and an eighteen-month one from the start of 2008 to the middle of 2009.)

They don’t follow any one rule. They look at all the data – on production, employment and unemployment, wages and incomes, business start-ups and closures, and so on – and make their judgement based on the totality of the evidence. An adult approach would be to do the same here.

And when a future Australian panel looks at the data, they would do two things differently from the herd. First, they would focus on broad trends, not on seasonally adjusted figures, which zig and zag because they rely on surveys, incomplete data and guesswork. The Bureau urges us to use its trend figures because they are more accurate and less likely to mislead us. It’s a pity that so many commentators prefer colour and movement to accuracy.

Second, the experts know that the real bottom line on economic performance is not GDP. It is GDP per head. Suppose Australia and Japan were both growing at 2 per cent. In Japan, where the population is falling, that would mean output per head is growing by more than 2 per cent a year. In Australia, where population growth averages 1.5 per cent, it would mean output per head is barely growing at all.

It’s a difference you can’t ignore, even though everyone from the Reserve Bank governor down keeps trying to pull the wool over our eyes. If we focus on real trend GDP per head, then the same national accounts data tells us we did have a recession in 1974, and again in 1990, and maybe in 2000, though that one was pretty minor.

The episode that really challenges the twenty-six-years-without-a-recession line is 2008–09, and its aftermath. We lost almost 150,000 full-time jobs. Unemployment rose by almost 200,000. The unemployment rate shot up from 4.2 per cent to 5.8. Output per head fell by just 0.7 per cent, but real net disposable income crashed by 6 per cent.

Okay, that wasn’t a recession like those of 1981–83 or 1989–93, but we were certainly an economy going backwards. Many Australians lost their jobs, or failed to find one, or were put on short working hours. One way or another, far more of us went backwards than were going forwards. It wasn’t a severe recession like its predecessors, but it was a recession all the same.

And it has been a recession without a full recovery. The unemployment rate is still 5.8 per cent. Australia’s adult population has grown by 2.6 million, but full-time jobs have grown by fewer than 500,000. GDP per head at the end of 2016 was only 7.5 per cent higher than it was nine years earlier; net disposable income per head was just 2.2 per cent above its pre-GFC peak.

If we had a panel of wise macroeconomists in Australia, I think they would conclude that we entered a recession. We were going backwards. Not for that long, and not that far, but we were clearly in recession for a few months. And in some ways, we have not yet shaken it off. •