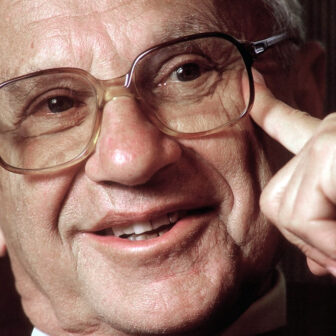

During his decades‑long career as professor of economics at the University of Melbourne — as well as stints at Monash University, the Melbourne Institute and the Business Council — John Freebairn has been among the few people to combine a thriving academic career with a deep, hands‑on engagement with Australian policy.

Many politicians and public servants have described to me his rare magic in combining academic rigour with clear communication and a talent for finding a cut‑through line. His retirement this year is a good excuse, if one were needed, to talk about tax reform, the subject of his major academic and policy contributions. Indeed, his research and writing read like a tax reform to‑do list.

Pick up the Financial Review on any given day and you’ll find opinion pieces grounded in John’s decades-long efforts to unpick the efficiency and equity impacts of different tax reform options. He has also made the case for these reforms directly to government as a consultant to the Henry tax review, on the review panel of the NSW Federal Financial Relations Review and in other forums.

And while he has done the hard work of tilling the ground, and has no doubt been pleased with some of the progress made on tax reform, much of the broad agenda he has articulated remains on the shelf.

The question is: why? Why, after so many decades of discussion and so many points of broad economic consensus, does tax reform remain so challenging? Is progress possible or is tax reform simply an impossible dream?

To answer this question, we need to first understand why someone with John’s rare talents decided to use them to make the case for tax reform. The bottom line is that tax matters. It matters to all of us: how much we collect and how it’s collected have implications for economic activity, governments’ capacity to deliver services, and levels of inequality.

One challenge we face when we talk about tax reform is that different people start with very different objectives. So let’s unpack some of those.

The first is economic efficiency. Economists rightly focus on the fact that how we collect tax — that is, what we tax and how much — affects the “economic drag” created by the tax system. Almost all taxes come with some loss of welfare, but some drag on growth more than others.

In a static sense, this can be measured by the “marginal excess burden” — how much economic activity is lost for every dollar collected. As Treasury and others have reminded us, this varies significantly between taxes.

But while there can be big differences in the estimates different modellers come up with, they broadly agree that a tax-mix switch from higher-burden to lower-burden taxes would deliver an economic dividend.

The most clear-cut example is a move from stamp duties to taxes on land. Stamp duties are among the most inefficient of taxes. Treasury estimates suggest that every dollar collected can reduce economic activity by up to 72 cents. Stamp duties discourage people from moving to housing that better suits their needs, and sometimes discourage people from moving to better jobs. Overall, they distort choices and gum up the economy.

Another reason we might advocate for tax reform is to make government budgets sustainable and future‑proof our tax system. At a time when the treasurer has just delivered the first budget surplus in fifteen years and we are seeing apparently endless revenue “upgrades,” it may seem strange to be having this conversation right now.

But government spending overall is projected to average 26.4 per cent of GDP over this period — compared with less than 25 per cent over the three decades before Covid — and revenues have not kept up. The federal government’s latest Intergenerational Report reminds us that the ageing population and the fallout from climate change will only see this fiscal challenge grow over the next forty years. The same is true of state budgets.

The implications of not taking policy action are clear: we are asking future generations to bear the costs of today’s inaction.

Governments have three levers they can pull to tackle long-term budget challenges: they can make economic reforms to “grow the pie,” they can increase taxes and they can reduce spending.

Pursuing policies to boost growth is critical. Much of Grattan Institute’s work has focused on this first lever. And I look forward to pursuing this in a big way when I join the Productivity Commission in a couple of weeks’ time. But, as Grattan highlighted in our Back in Black? report earlier this year, we can’t rely on higher growth alone to close the budget gap.

Given the scale of the challenge, governments will also need to find ways to reduce spending and/or boost revenue. After a decade of looking at this challenge I have come to the view that we will need to do both. The scale of the challenge, and the greater buy‑in that can come when the costs are spread across the population are arguments for looking to both sides of the budget for answers.

If we do accept that some additional revenue is needed to respond to the structural challenge outlined, then we want to make sure that additional revenues are collected with the lowest possible economic costs. In fact, this can also help us grow the pie: more efficient, less distorting taxes are one of the Productivity Commission’s “enduring policy priorit[ies]” for productivity growth.

On the other hand, if we do nothing, we may end up on the path of least resistance: collecting ever-more revenue through ever‑creeping taxes on wage and salary earners. Bracket creep may be the most politically painless way to raise revenues, but it is far from the best.

Tax reform for budget sustainability should aim to broaden the base of income taxes — looking at loopholes and overly generous concessions as well as orientating our collections towards more efficient bases such as consumption, wealth, externalities or resource rents. In other words, we need to revisit the John Freebairn back catalogue.

The atrophying of tax reform in recent decades might make us pine for a golden era. In truth, though, tax reform has never been easy. So let’s take a short history lesson — five decades of tax reform in five minutes — and see what we can learn.

Let’s start in 1975. Many elements of our tax system today can be traced back to the 1975 Asprey tax review. This comprehensive, independent review was commissioned by the McMahon government in response to concerns about bracket creep and tax evasion. (Sound familiar?)

The review outlined the basic principles of efficiency, fairness and simplicity that remain our lodestars and made the case for many aspects of the system we have today, including fringe benefits tax, capital gains tax and a broad-based consumption tax.

But the report initially had little impact. Landing in the final, tumultuous year of the Whitlam government, it was written off in the media as a “tax flop,” and its main recommendations not adopted.

It took another decade for momentum to build. In 1985, fresh off the Prices and Incomes Accord and the floating of the dollar, prime minister Bob Hawke and treasurer Paul Keating turned their attention to tax reform. They released a draft white paper on reform options and hosted a tax summit with unions, business and community groups.

These processes resulted in the adoption of some of Asprey’s recommendations, including a capital gains tax, negative gearing reform, fringe benefits tax, dividend imputation and taxation of foreign source income.

But it was a case of “two steps forward, one step back.” A broad-based consumption tax was central to Keating’s original vision but failed to win support and was dropped. And the pioneering negative gearing reforms were repealed two years later.

So the Asprey blueprint was partly implemented. Another long reform slumber followed. The next big push was John Hewson’s Fightback! platform for the 1993 election, which proposed, among other things, a broad-based consumption tax. Fightback! proved to be a false start — Hewson lost the “unlosable” election — but consumption taxes were back on the agenda.

Another six years had to pass for the reform dream to become reality. Prime minister John Howard took a proposal called A New Tax System, which included the GST, income tax cuts and the abolition of a host of inefficient state taxes, to the 1998 election. He narrowly won and the legislation ultimately passed in 1999, twenty-four years after the release of the Asprey report.

We’ve seen precious little in the way of significant, lasting tax reform since then. The landmark Henry review is close to celebrating its fourteenth birthday with most of its meaty recommendations untouched. State and territory tax reform has also, mostly, been a non-starter, despite a succession of reviews converging on similar recommendations.

So what should we take from this history? What can we learn from those rare moments when we managed to overcome the many barriers I outlined before? I see four key steps for would-be reformers.

Step 1: Put reform on the agenda

History shows that an external push is often needed to put tax reform on the agenda. In 1985, fears about Australia’s economic decline and resentment about tax avoidance pushed the discussion forward. In 1997, the High Court’s decision to strike down a key state tax left a significant hole in the states’ budgets and opened the reform window for the GST.

The optimist in me can’t help but draw parallels with last month’s High Court decision to strike down Victoria’s electric vehicle levy. Perhaps we might have another golden opportunity for a grand intergovernmental tax reform bargain on our hands?

Tax reform was hardly on the radar for the Howard government until civil society groups — representing both social services and business — started championing the cause. The Australian Council of Social Service and the Australian Chamber of Commerce and Industry, in particular, pushed in a coordinated way, culminating in the National Tax Reform Summit in 1996. The strong and united messaging put the GST and tax reform firmly back on the political agenda.

Today many groups feel similarly. Federal independent MP Allegra Spender has been spearheading a push to unite academic, business and civil society leaders to build some consensus on the need for tax reform and the way forward.

Step 2: Build a coherent package

While rewriting thousands of pages of the tax code at once would be a recipe for chaos, relying on incremental changes is probably not going to get the job done either.

History shows that reform packages can work well. In 1985, reforms that broadened the income tax base were bundled with income tax rate cuts and tax avoidance measures — a coherent story to sell to the public. In 1999, removing narrow and inefficient, but lucrative, state taxes and widely variable wholesale sales taxes made sense in the context of the broader GST deal shoring up state budgets.

Packages provide the opportunity to dull the sting of reform by sharing the costs more broadly and perhaps offering some compensation to the losers.

The major tax reforms of the past two decades have come at an upfront cost. The GST package overcompensated households by about $12 billion a year, through personal income tax changes and increases to pensions and family payments. This was a key part of its sales pitch. Former Treasury secretary Ken Henry recalled that:

the distributional tables outlining the impact of the GST were the most “thumbed” part of the documentation, certainly by those Treasury officers answering phone queries. Of course, it helped that every individual and family represented across all income levels appeared better off.

Compensation packages are particularly important where there are equity implications for lower-income households. Australians tend to reject reforms that seem unfair. But, crucially, potentially regressive reforms, such as broadening the base of the GST, can form part of larger, fairer reform packages. For example, the carbon tax package involved substantial assistance for households, particularly lower-income households, to address concerns that poorer households would be particularly affected by higher energy and food prices.

Given the long‑term budget challenges, high‑cost packages of the type needed to ensure there are “no losers” from tax changes are difficult to justify. But it is certainly possible to design packages with much lower upfront costs that still compensate vulnerable households. For example, Grattan’s previous work on the GST proposed a revenue-positive package, with a 15 per cent GST, cuts to income taxes, and an increase in welfare payments, that would leave the lowest 40 per cent of income earners better off on average.

Packages might also help address some of the other political economy challenges of reform. Ironically, opening up more fronts in the tax debate may quiet some of the more over-the-top reactions. As Ken Henry has argued, “if you give a lot of well-armed people only one target to shoot, it will take a pounding. Incrementalism sets up a single target on a battlefield occupied by well-resourced attack forces.”

And while my goal here is not to opine on the “what” of tax reform, let me give a sense of some of the types of packages that a government could put forward.

• On income tax reform, we could return to the logic of 1985: broadening the income tax base by winding back loopholes and overly generous concessions, to support a cut in rates. This could include targeting discretionary trusts and super tax concessions, or reforming capital gains tax — either by reducing the capital gains tax discount or returning to the indexation of gains.

• Another package could tackle the inconsistent tax treatment of different savings options, to reduce the distortion in savers’ choices and simplify the system. This would mean lower taxes on interest from bank accounts and bonds, and somewhat higher taxes on other savings vehicles such as superannuation (which is very lightly taxed even after accounting for the long holding periods). An even “bigger bang ” version would be a dual income tax where income from savings is taxed at a consistent low rate, regardless of source.

• On the corporate tax front, we could better tax resource rents to fund a company tax cut. We could also consider more wholesale reforms such as an allowance for corporate equity or a cash flow tax.

• For states, inefficient stamp duties could be swapped for land taxes over time, along the lines of the ACT government’s gradual phase-in or Victoria’s switch for commercial and industrial property.

• In transport, distance-based congestion charges that vary by location and time of day would be a more efficient replacement for the declining fuel tax base.

• Finally, to aid the climate transition, the government could substantially expand and strengthen the safeguard mechanism, while eliminating many higher-cost interventions to reduce emissions, such as the fringe benefits tax exemption for electric vehicles. The package would deliver both faster and lower-cost emissions reduction.

But while packages make a lot of sense, would‑be tax reformers can’t be too purist. Incremental changes in the right direction are still an improvement on the status quo, and in some cases these more incremental steps can ultimately take us towards more comprehensive packages.

Step 3: Embrace the “vomit principle”

The next step is making a compelling case for change. Complicated reforms that can’t be explained are unlikely to win support, and are more vulnerable to scare campaigns. We saw this in 2019 with the confusion about franking credits — irredeemably branded a “retirement tax” — and in 1993, when John Hewson’s tortured explanation of the effect of a GST on the price of a birthday cake helped turn the tide of popular opinion against the new tax.

Convincing the public of both the necessity of change and the proposed solution takes time and political capital. Howard and Costello spent two years and a lot of political energy highlighting the structural problems with Australia’s tax base prior to releasing their reform package in 1998.

While no one likes to pay extra tax for the fun of it, many are more inclined to agree when higher taxes are linked to better services. The proportion of Australians favouring “less tax ” has declined since the late 1980s, according to the Australian Election Study, and the proportion preferring “more spending on social services” has risen. At the time of the 2022 election, 39 per cent indicated they would prefer less tax, 31 per cent more social spending and the remainder said “it depends” — presumably on the nature of both the tax and the spending increases.

My reading is that when our political leaders do the work of tilling the ground and explaining changes and why they are needed, then hearts and minds can shift.

A more recent example, albeit one contrary to received wisdom, was the then‑Labor opposition’s 2016 policy to wind back negative gearing and reduce the capital gains tax discount. We have already discussed some of the public challenges that reform faced, but it is also worth remembering that negative gearing had formerly been viewed as a “political untouchable.”

Indeed, since the Hawke government lost its nerve and reversed its decision to wind back negative gearing in 1987, it has been considered the “sacred cow” of Australian politics. When Labor announced it would introduce these changes to improve housing affordability and contribute to the budget bottom line in 2016, just over a third of Australians supported removing or limiting negative gearing.

But, over time, as shadow treasurer Chris Bowen and others made the case, support gradually increased. Support for limits on negative gearing climbed almost 10 percentage points, from 34 per cent in March 2016 to 43 per cent in December 2018. By the time of the 2019 election, the Australian Election Study estimated that 57 per cent of Australians supported limiting negative gearing.

To me this is a textbook example of what some political strategists call the “vomit principle ” — repeat something until you feel like you are going to vomit. Only then are you cutting through.

Labor has since dropped the policy, of course, and many reading the media commentary would have gained the impression that the tax reform agenda was deeply unpopular and “to blame” for Labor’s surprise election loss in 2019. The reality was far more complex.

In any case, it’s not just down to politicians to argue for reform. Successful tax reforms need a diverse cheer squad. Historically, academics, premiers, public policy institutions, and community groups have all been important advocates for tax reform. Providing incentives for academics and non-profit organisations to participate in public debate would be a useful step to building these coalitions today.

Step 4: Make it stick

Somewhat dispiritingly, even after these hurdles have been overcome and tax reform has been passed, the job isn’t done. Tax issues tend to linger on the agenda, often for entire parliamentary terms, and reforms sometimes don’t stick. As we’ve just seen, negative gearing reforms were undone after just two years in 1987. The carbon tax and mining tax were repealed. The Perrottet government’s hesitant steps towards stamp duty reform were wound back by the new NSW Labor government.

But in other cases the controversy does die down after reform is enacted. Sometimes social norms change quickly — for example, in Stockholm, congestion charging was much more popular after it had been implemented than before, and many people did not even remember that they once opposed the idea.

In Australia, plenty of tax changes that were controversial at the time — the GST, fringe benefits tax, capital gains tax — are now so entrenched that there is no constituency or any visible public appetite for their removal.

Reforms are more likely to stick if they create positive feedback loops — for example, if they result in institutional shifts, if reform winners can be used as advocates, or if businesses make big investments under the new regime. Taking the GST as an example, the Australian Taxation Office and businesses made significant investments in the infrastructure for administering the new scheme; and the changes to federal financial relations created a key constituency — state governments — who had a strong interest in its continuation.

What are the prospects for tax reform? I, for one, remain optimistic.

First and foremost, I don’t think we have much choice. The slow‑burning platform is still on fire, and over the coming decade the gap between our spending needs and our tax system’s capacity to meet them without ever higher taxes on employment income will be stretched to breaking point.

More and more questions are being raised about the sustainability and intergenerational fairness of our current tax mix. Without action, expect them to get louder and louder over the coming decade. Tax must also come into the conversation if we are going to deliver our policy objectives in other areas, including the green transition.

Second, I am confident that our leaders can make a positive case. While I have focused on the challenges, I am also heartened by the leadership we are seeing on difficult reforms in other areas.

Over the past three months the Commonwealth and state governments have made strong commitments to boost the supply of housing through politically challenging reforms to planning laws. If they can pull it off, this would be a huge economic and social reform, and one that has been in the too-hard basket for many decades.

As a reform proposition, making the case for greater housing density is probably of the same order of difficulty as making the case for major tax changes, and yet we are seeing both levels of government go after it in a big way.

Third, I think there is appetite across a broad swathe of interested parties to shift the dial. Allegra Spender’s tax reform round tables suggest at least a consensus among business, academia and civil society that something needs to change, even if there is not yet broad agreement on the reform priorities. A process to harness this agreement, ideally led and shaped by government, could help move the conversation forward.

Finally, I have confidence in the Australian people to see through the noise. Scare campaigns and a shouty media are one thing, but if state and federal governments can hold their nerve in the rule in/rule out game long enough to make a positive case for change, and keep making it, history shows that people can be brought along.

Tax reform is hard, but it’s not impossible. It’s time we woke up from our slumber and became a little less afraid and a little more Freebairn. •

This is an edited version of this year’s Freebairn Lecture, delivered at the University of Melbourne last week. The full lecture, with charts and footnotes, is here.