A DECADE AGO, in response to the Asian and Russian economic crises, the finance ministers of the seven biggest economies created a new organisation, the G20. For the next nine years the influence of the G20 grew, but slowly. Then, last year, the G7 handed it the role of coordinating the global response to the financial crisis. For the first time, the G20 was in the driver’s seat.

Made up of nineteen nations and the European Union, the G20 represents 85 per cent of global GDP, 80 per cent of world trade, and two-thirds of the world’s people. In addition to the G7 nations, it includes Brazil, China and India; Indonesia, the world’s most populous Muslim nation; Turkey, the bridge in so many ways between Europe and the Middle East; and South Africa. Even Australia gets a guernsey. The G20 is far better suited than its predecessor to the job of steering the world through a crisis.

This transfer of control is a major step forward, and our government is to be congratulated for supporting the move. But there is also another game in town, and our government seems to believe that supporting one game means raining on the other.

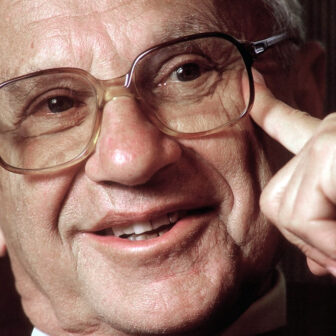

The alternative to the G20 is the United Nations, which in late June held a conference to explore approaches to the global financial crisis. A background document for the conference was the report of a UN Commission of Experts on the crisis, headed by the Nobel laureate and former chief economist of the World Bank, Joseph Stiglitz. Yet despite the eminence of the report’s main author, and the critical need to consider a range of approaches to a crisis as severe as this one, the Australian media gave almost no coverage to the UN process.

This lack of interest is strange because our government wasn’t simply uninterested in the UN process, it obstructed it. When the recommendations of Stiglitz’s report were discussed at the United Nations in the month leading up to the conference in June this year, Australia joined other rich countries in blocking and watering down most of the innovative proposals. The directive from the prime minister’s office was to support no process that would undercut the centrality of the G20. The upshot was that the UN conference issued a series of bland resolutions largely devoid of real content.

Before we look at Stiglitz’s recommendations it’s worth going back to the decisions made by the G20 nations at their meeting in London in April this year. The key decision of the meeting was a plan to inject an extra US$1 trillion into the world economy. One-quarter of this sum is to be committed to supporting trade finance, another quarter is to go into new Special Drawing Rights, or SDRs, and the remaining half into extra resources for the International Monetary Fund to lend to countries.

This looks okay. It reads even better. The G20 directives are filled with high aspirations and exhortations to enhance the “open trade and investment regimes, and effectively regulated financial markets that foster the dynamism, innovation, and entrepreneurship that are essential for economic growth, employment, and poverty reduction.” Who can be against growth, employment and poverty reduction? Surely the G20 is on the right track?

But when one reads the detail a different picture emerges. Ensuring financing is available for trade is important, but this is merely replacing private funding with public money. It doesn’t actually do something extra to respond to the crisis, it merely patches a crisis-caused hole in the system.

SDRs are a form of reserve assets for countries. They can be drawn down at very modest interest rates and are a fine source of capital. At times like these, extra SDRs are the sort of medicine that will help poor countries (which is why Stiglitz recommended them in his report). But countries can only draw down SDRs in proportion to their quotas, which means the majority of SDRs are available to the United States and European countries. So this is the right medicine and better than nothing, but in doses too small to cure the disease.

In contrast, the extra loans that will be channelled through the IMF are the wrong sort of medicine for two reasons. First, this new credit facility requires substantial conditions be met by borrowers which will exclude the countries that most need the assistance. Second, these countries don’t need loans, they need a two-year interest holiday on all their official loans (from developed countries and from multilateral agencies such as the IMF and World Bank). A halt on interest payments would give poor countries cash to direct towards domestic stimulus. More loans do the same thing, but at the long-term expenses of more indebtedness, for economies already staggering under unsustainable debt burdens. Short-term gain for long-term pain is the wrong medicine.

So why did the G20 do what it did? Well, it was cheap. Official loans and trade finance facilities are always repaid by debtors, because when times are really tough these are the only available funding sources. So the G20 nations know all these funds will be repaid. Yet a trillion dollars still has a real ring to it – promising a trillion is insulation against being charged with doing too little. And, finally, this is in part a stimulus package for western commercial banks; past experience tells us that a portion of the new money lent by the IMF will be used by middle-income debtor countries to repay due bank debt. So there is some real self-interest in these measures.

What is missing in all the G20 documents is any evidence of any thinking outside the box that brought us the global financial crisis. We need to rethink fundamentally the role of capital and financial products and the privileges and rights we, the people, confer on banks by granting them a banking licence. Financial crises of increasing severity have been the defining feature of the past fifteen years and this is to be expected, because our current financial system was designed for a non-globalised world of finance that no longer exists.

THIS IS WHERE Stiglitz and his fellow commissioners come in. The commission, which issued a preliminary report a few weeks before the G20 meeting, divided its recommendations into two groups: immediate measures, and longer-term systemic reforms. As an immediate response, the commission proposed that $250 billion of SDRs be issued through the IMF for each year the crisis persists. It proposed that rich countries move quickly to donate 1 per cent of their own domestic stimulus packages to low-income countries, to be applied there for similar purposes, and that regional liquidity arrangements such as the Chiang Mai initiative in East Asia be used to inject extra funds into regional economies. The commission also recommended establishing a new credit facility without conditions attached, and proposed an international panel on economic policy comprised of government representatives, leading academics and others, similar to the Intergovernmental Panel on Climate Change, to advise on coherent international responses to the global economy.

As we’ve seen, the G20 adopted one of these recommendations – the $250 billion in SDRs – but only as a once-off measure. The proposals that would have been an immediate help to developing countries or would have significantly reshaped global economic relations were not taken up in London.

The Stiglitz Commission tackles the longer-term systemic reform task with many recommendations. New financial mechanisms should be introduced to mitigate risk, including international institutions lending in local currencies. The governance of the IMF and World Bank should be reformed to make them responsive to the needs of their clients, the developing countries. Highly indebted countries should be given a moratorium or partial cancellation of debt, and new mechanisms for handling sovereign debt restructuring, such as a sovereign bankruptcy court, should be introduced. A Global Economic Coordination Council is needed at the level of the UN General Assembly and Security Council, meeting annually, as well as a Global Financial Regulator and a Global Competition Regulator. And, perhaps most controversially, the US dollar should be replaced as the global reserve currency by something like a greatly expanded SDR regime.

The first four of these proposals are the most do-able. There are strong reasons why all reschedulings of rich country to poor country loans through the Paris Club (a group made up of the financial officials of the world’s nineteen richest countries) should be in local currency, as should all lending by international financial institutions such as the IMF and World Bank. Our current system places the currency risk on the party least able to bear it, the borrower. This is nuts. Lending in local currency puts the currency risk on those best able to bear it and hedge against it, the lenders.

Likewise there are strong arguments for debt relief for more countries than currently receive it, and for an orderly, rules-based approach to sovereign insolvencies.

The remaining recommendations in my summary of the Stiglitz recommendations are far more controversial. To be effective, global financial and competition regulatory authorities are going to require real power to make rules, which raises all sorts of sovereignty concerns. And the recommendation for a new reserve currency made me wince. Not because it is silly; in fact, it is sensible, essential and probably inevitable. But one suspects the United States will die in a ditch to try and keep the dollar as the global reserve currency. So this recommendation alone is likely to attract the full force of US opposition to the report.

A new reserve currency is almost inevitable because the current arrangement is leading to ever greater volatility, and because China is fed up with it. Premier Wen Jiabao has said he is worried that China holds most of its reserves in dollars, and well he might be, as the decline of the dollar in recent years has cost China a fortune. Twice this year the governor of China’s central bank has called for a new reserve currency regime focused on special drawing rights. China Inc doesn’t make such comments without careful consideration, and it is hard at work researching alternatives.

The Stiglitz Commission may have been better off analysing why the move to a new reserve currency is highly likely and highlighting the benefits of an orderly transition and the potentially devastating effects of China and other countries dumping their dollar-denominated bonds. The report presents the sound technocratic arguments for change, but giving the practical reasons to seek to manage this process may have engendered more listening, and less opposition, in Washington.

But this is just one criticism. Overall the Stiglitz Commission report is informed by a different type of thinking than that which brought us the global financial crisis. As Joseph Stiglitz wrote earlier this year, “Financial markets are not an end in themselves, but a means: they are supposed to perform certain vital functions which enable the real economy to be more productive: (a) mobilising savings, (b) allocating capital, and (c) managing risk.” The financial crisis was a direct result of treating the creation of financial products as an end in itself – as a valuable driver of economic growth independent of the products’ effects.

Stiglitz believes a financial sector exists to provide capital, a necessary input into the productive process. Just like telecommunications, electricity and roads, a financial system is an important piece of infrastructure. There’s nothing new in this thinking. Everyone thought this way thirty years ago. It is just that many people forgot it. More fundamentally, one gets the impression that Stiglitz believes economies exist to advance societies, rather than societies to advance economies. Thus he approaches the issues from a framework quite different to that of the nations that shaped the G20 response to the GFC.

We have a national history of going All the Way with foreign ideas. This time our government has committed itself fully to the G20’s response to the crisis. In doing so we have missed a major opportunity to promote the only sort of thinking that will stop recurrent financial crises. The United States is sufficiently grown up to value a friend that has its own mind. We no longer need to play follow the leader. Our financial interests are profoundly different from those of the United States and Europe. Our primary interest lies in a fair and functional global financial system. The Australian people have a right to expect bigger and better thinking on these issues from our leaders. The next G20 meeting, late next month in Pittsburgh, would be a great place to start. •