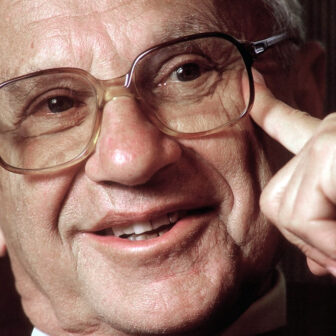

IF WE CAN single out one person as the father of modern economics, it would have to be Paul Samuelson. His Economics: An Introductory Analysis (first published in 1948 and still in print, now in its nineteenth edition) became the best selling textbook in history. He was the first American to win the Nobel Prize for Economics (1970). Samuelson, explained Stephanie Flanders in the Financial Times in December, “did more than any other theorist to turn economics from a scattered selection of insights into a social science.”

The tributes poured in when Samuelson died on 13 December last year. Although his importance cannot be denied, it lay not in developing a true science of economics but in creating a key ideology of modern management.

PAUL ANTHONY SAMUELSON was born in 1915 in Gary, Indiana, the son of Jewish Polish immigrants. The family moved to Chicago in his childhood. Even when the twenties were roaring, both were tough towns, and in the 1930s both were hit hard by the Depression. The Samuelson family was middle-class (his father was a pharmacist), but young Paul was an observant child and never forgot what happened in those years.

He excelled at school, and studied economics and mathematics at the University of Chicago. In 1936, he went on to postgraduate studies at Harvard, probably the best university in the United States at that time.

The economic orthodoxy of the day proclaimed the virtues of free-market competition, but in the midst of the Great Depression this had lost much of its plausibility. Some of Samuelson’s generation embraced Marxism, among them Paul Sweezy, the brilliant son of the founder of First National City Bank (now known as Citibank), who was tutoring in Economics at Harvard. Samuelson rejected this approach. But when John Maynard Keynes’s General Theory of Employment, Interest and Money appeared in 1936, he followed the debates over its criticisms of mainstream economics keenly.

Keynes was a supporter of a free-market system. But having won a fortune on the London stock exchange, lost it, and won another one, he thought that the orthodox view failed to understand investment behaviour and the role of money and credit. As a result, capitalism was a less stable system than the theory depicted. Government intervention was necessary if the market was to work smoothly and deliver desirable outcomes such as full employment. To show how this worked, he developed the basics of what we now call macroeconomics.

After completing his PhD in 1941, Samuelson was employed by the US Air Force at the Massachusetts Institute of Technology, developing aircraft-tracking equipment. He worked on some of the earliest computers and was deeply impressed with the power of the new technology.

After the war, he returned to academic life. Harvard turned him down, but in 1947 MIT offered him a Professorship in Economics. The economics department at MIT was an academic backwater, but Samuelson transformed it into the leading centre of teaching and research on economics in the United States. He recruited many highly talented staff, and the department attracted many of the brightest students from across the country.

In the 1950s Samuelson and his colleagues created what became known as the “neoclassical synthesis.” Taking ideas from the neoclassical economists of the late nineteenth century and combining them with Keynes’s ideas, they used the latest computer technology to create elaborate mathematical models of the workings of an economy. Samuelson himself developed many of the key concepts and theories.

He was confident that this provided government policy-makers and business executives with powerful management tools. The tools were soon embraced in Washington, Wall Street, and by the universities. Samuelson’s version of economics quickly became the mainstream. In 1970 he was awarded the Nobel Prize for this work. A string of his MIT colleagues followed him to Stockholm to pick up their own prizes.

MIT economics graduates went on to fortune and fame. Many now play key roles in the American system of power. As Wall Street Journal reporters Justin Lahart and Jon Hilsenrath remark: “MIT PhDs now dominate the profession and hold many high positions in government, including [Ben] Bernanke [chair of the US Federal Reserve] and Christina Romer, chair of the Council of Economic Advisers.”

Samuelson himself helped take his new economics to the corridors of power. He was an adviser to John F. Kennedy’s election team in 1960 and helped shape the economic policies of the Kennedy and Johnson administrations. From 1966 to 1981 he wrote a weekly column in Newsweek. By 1970, he was the best-known populariser of modern economics in the United States.

THIS WAS the pinnacle of Samuelson’s public prestige. After 1970, the world economy slowed down, unemployment rose and inflation accelerated. According to Samuelson’s economic models, this combination wasn’t supposed to occur. Critics from both the left and the right became more vocal. Those from the right, led by the energetic Milton Friedman, became increasingly influential.

Friedman developed theoretical arguments against Keynes and Samuelson. But the popular appeal of his arguments lay in his denunciations of “big government” and “socialism” and his appeals to America’s tradition of hardy individualism. From such ideas there emerged over the 1970s a distinctive set of right-wing libertarian ideas, now known as “neoliberalism.”

With Ronald Reagan's election in 1980, neoliberalism became the dominant approach to policy in the United States. The new president set about deregulating business, cutting taxes and welfare spending, and privatising public services. The Federal Reserve was instructed to cut inflation, whatever the cost in terms of unemployment. To remedy this, employers were encouraged to make labour markets flexible by deunionising and casualising their workforces.

Samuelson agreed with many of these ideas in principle, but not with the brash, reckless optimism of the neoliberals. He feared that over-zealous deregulation would throw capitalism back into its old pattern of boom and bust. He was especially concerned that financial deregulation was leading to excessively easy credit, sloppy management and reckless speculation.

The global financial crisis of 2007–08 vindicated Samuelson’s concerns. In what is probably his last article, he wrote: “Unregulated capitalism has led everywhere to its own self-imposed defeats… The middle way – regulated private markets plus government stabilizers – wins out all over the world when given a chance.”

Samuelson supported the stimulus package adopted by the Obama administration and probably derived considerable personal satisfaction from the fact that the two key architects of Obama’s policies, Larry Summers and Ben Bernanke, are both products of his old department at MIT. Summers was also his nephew.

DESPITE Samuelson’s criticisms of their excesses, the neoliberals were part of the economics he created. One of the fashionable theories in the 1990s was the Efficient Market Hypothesis. This was the creation of Louis Bachelier, a French mathematician of the late nineteenth century, but Samuelson played a central role in rediscovering it and making it a fable for our time.

According to Bachelier, prices efficiently summed up all available information on market conditions. Provided each person responded rationally to the prices they confronted, the individual mistakes they made would be of no account. These were random, and would cancel each other out. This may be true in an ideal world in which decisions are based on individual calculation, uninfluenced by non-price considerations such as the behaviour of other people. But in the real world, in which people learn from each other, imitate each other’s behaviour and respond to collective beliefs, things are a bit more complicated.

This did nothing to prevent the Efficient Market Hypothesis becoming highly fashionable in the neoliberal era. This is itself evidence of the importance of fashions and fads in human behaviour and thus shows that the Efficient Market Hypothesis was misleading. But the story of derivatives trading shows that such pseudo-scientific beliefs can cause real damage.

When financial markets were deregulated, traders began to speculate not only on asset prices, but also on the price of assets derived from other assets – such as a pledge to sell a particular asset at a certain price at a certain point in the future. These derivatives were freely sold and resold, packaged and repackaged, until the underlying real assets were lost entirely from view. This did not reduce risk, it merely concealed it.

While the prices of such derivatives rose, fortunes could be made overnight by buying them and reselling. Easy credit and low interest rates meant that this could be done with borrowed money. Financial institutions eager to tap into these new income streams backed the investors, and billions of dollars were poured into the trade.

Common sense said that such speculative trading was risky, especially when done with borrowed money. But the neoliberals knew better. Free markets are always efficient. Mistakes do not matter, crises could not happen. This optimism was boosted by fancy computer tools, which tracked and predicted asset price movements, allowing investors to reduce the risks they were running.

The central figure in developing the new tools was Robert Merton, who shared a Nobel Prize for Economics in 1997 for this work. Merton was one of Samuelson’s star students, and on graduation became a member of the MIT dream team. The computer programs he built were based on models of stock price movements originally created in the 1960s by Samuelson himself.

In 1998, Merton helped found Long-Term Capital Management to apply these new tools in the real world. LTCM unexpectedly collapsed, having lost nearly $5 billion in four months. Panic gripped Wall Street and the US Federal Reserve hastily doled out large amounts of money to LTCM creditors to avert a chain of collapses across global financial markets.

Nothing was learnt from this episode. Once the immediate panic subsided, it was back to business as usual, and an atmosphere of feverish optimism returned. Under George W. Bush, government, investors and households all piled more and more onto America’s mountain of debt, building up the paper value of their assets. When these paper values collapsed, half of Wall Street was suddenly vaporised. By then Merton was working for Trinsum Group, a financial advisory company.

In a television interview after the crisis, Merton admitted that the new financial tools he had helped create were not perfect. There would always be a few things their creators overlooked. From time to time, the Nobel Prize winner conceded, problems would occur. But on the whole, the new tools were examples of successful innovation, and they had made the world richer and better since the 1970s.The basic issue, he argued, was that “successful innovation is going to be running ahead of the infrastructure to support it.” The suggestion was that society should support innovators like himself more generously.

On the same program, Samuelson took a different view of the financial crisis: “Fiendish Frankenstein monsters of financial engineering had been created, a lot of them at MIT, some of them by people like me.” Managers had relied on these tools, but they had no idea of the ideas they embodied, and no understanding of the risks involved in the lucrative trade in derivatives. “I can tell you,” said Samuelson, “because I serve on so many nonprofit boards, where half of us are academics and half of us are from Wall Street, that there's no CEO who understands at all a derivative. All they know is that somebody tells them in their organization, ‘We've got a wonderful profit center.’”

Scarcely a month later Merton’s employer, Trinsum Group, went bankrupt. Others caught by the crisis included Samuelson’s nephew, Larry Summers. As president of Harvard University in 2001–06, he had overseen investments of $50 billion. In 2008, Harvard signed agreements to pay off the debts he created over the next forty years. By then Summers had moved on, joining the Obama administration as director of the National Economic Council.

The differences between Samuelson and the younger neoliberals was less one of theoretical substance than of temperament and experience. Samuelson recognised this in an interview with the Wall Street Journal in 2009: “The typical pundit today would be somebody who might have been my student at MIT 25 years ago. I have great admiration for Ben Bernanke. But having been born in 1956 he did not have a feel for what it was like. If you were born after 1950, you really don't have the feel of that Great Depression in your bones. Being a bright boy at MIT, it's not really a substitute for that.”

MOST MODERN economists are technicians. They take for granted the assumptions on which the computer models they use have been built, and those assumptions are the ones adopted by Samuelson. To understand the fundamental weaknesses of the whole imposing edifice, it is helpful to revisit the foundations on which he built it.

As an undergraduate in the 1930s, Samuelson saw the economics he studied as a disparate collection of ad hoc explanations. Keynesian macroeconomics was only the latest addition to this collection. What the discipline needed, he believed, was a set of unifying, fundamental principles, like those Euclid had provided for geometry and Newton for physics.

The neoclassical economists had developed a mathematical model of how an economy works, based on the fundamental principle that equilibrium is maintained across the whole system as supply and demand adjust to changing prices in free markets. Radicals such as Paul Sweezy argued that Keynes’s criticisms were so damaging that the whole framework had to be abandoned – like the capitalist system, for which it was in essence a sophisticated apologia.

Samuelson believed that the neoclassical model actually provided the fundamental principles that could unify the whole field of economic science. The problem was that it remained abstract and theoretical. He set about recasting the approach to make it practically applicable to every area of economics. The volume and complexity of the calculations involved had previously made such a project impracticable – but these calculations could now be handled at lightning speed by computers.

The key to science, Samuelson believed, was mathematics. Economics should follow the successful example of the natural sciences, above all physics. He borrowed the maths he needed from nineteenth-century thermodynamics. Just as it had developed a model of the interactions of countless particles according to a few basic principles, economics could model the interactions of countless multitudes of people through markets.

Particles do not make decisions, but people do. Samuelson believed that the neoclassicists had dealt adequately with this by adopting utilitarian psychology and assuming that people seek to increase their pleasure and minimise their pain. The beauty of this assumption was that these outcomes could supposedly be measured, aggregated and compared. People do this all the time – they gather relevant information, compare possible outcomes of a decision, and choose the option that delivers the greatest benefit. In the neoclassical jargon, they are rational decision-makers who maximise utility.

Samuelson realised that the behaviour of people who are individualistic, self-interested, rational calculators could readily be modelled on a computer. This provided modern economics with its Euclidean axioms. On this basis, Samuelson was able to integrate the microeconomics of neoclassical theory and the macroeconomics of Keynes. And, just as architects applied Euclid’s principles to construct bigger and better buildings, economists could develop tools for business managers and government policy-makers.

This gave economics the look of a “hard” science akin to physics and chemistry. It was mathematical, abstract and universal in character, rigorous in its logic, and concrete and practical in its applications. This was in contrast to the biological sciences and what passed for social science, which lacked the fundamental unifying general principles, the mathematical methods and the precision that economics had now supposedly attained

The result was prestige and funding that other social scientists could only envy. Although most economists have remained loyal to the image of inherent superiority that Samuelson shaped, modern economics failed to develop the predictive power of the hard sciences on which it was modelled. The standard response of economists was that offered by Merton – nobody is perfect, we need to do more work, you should give us more money.

EUCLID BUILT his geometry on axioms that were precise and accurate. His deductions were not only logically sound, but tested in practice over a couple of thousands years. The axioms on which Samuelson built the mathematisation of economics were not at all like that, and the precision claimed for economics was illusory.

One problem was obvious from the very beginning. Neoclassical economics assumed that pleasure and pain could be meaningfully measured, aggregated and compared. In his Theory of Political Economy, published in 1871, W.S. Jevons, a founder of this school, worried that while fine in theory this could not be done in practice. Jevons’s successors had no such worries. In his tribute to Samuelson, Professor Edward L. Glaeser explained the basis of his “great formalisation” of economics in these words: “The start of the economists’ toolbox is the utility function – a somewhat mythical thing… – that we pretend that human beings maximise.”

So, in contrast to Euclid’s axioms, Samuelson’s economics was based on a concept that is intangible and unmeasurable – indeed, in Glaeser’s words, a fiction. Almost any outcome can be claimed to be rational.

Samuelson saw this problem. He argued that utility could be deduced from empirical behaviour – and that utility could then be used to explain empirical behaviour. In other words, the existence of a given pattern of behavior can be explained by that pattern of behaviour’s existence. This is circular reasoning, and the concept of utility is redundant.

Such flaws in the foundations had practical consequences. As the neoliberal boom reached its climax in what looked to many outsiders like a mad rush to self-destruction, economists assured us that this was in fact perfectly rational behaviour. The pragmatic Samuelson knew better, but those economists were naively repeating theories they had learned from him. Even in retrospect, when economists conceded that some managers and programmers had made a few mistakes, they still saw themselves as paragons of rational decision-making. In his 2008 interview, Merton declared: “I'm Rational Man, with a big ‘R,’ big ‘M’.”

To achieve the mathematisation that he believed was the essence of science, Samuelson needed simplicity and predictability. This was easier to achieve in physics than in the biological and social sciences, whose subject matter is highly local and historical, and irreducibly complex in character. To achieve his aim, Samuelson had to sacrifice a realistic picture of human behaviour. To give economics the prestige of a “hard” science, he had to ignore almost everything biologists, psychologists and social scientists have learned about human beings over the past couple of centuries.

Unlike the particles of a thermodynamic system, human beings live and die. They reproduce sexually, producing offspring who have to be nurtured from birth to adulthood. They are social animals, living in groups, communicating and learning from each other constantly. They work together, or compete against each other, using tools and technology to obtain food, shelter, clothing and much else from nature. In doing this, they have transformed their environments. All this generates complex and often conflicting emotions – humans are animals that love, and hate. To manage all of this, they have formed rules and institutions, and they keep on experimenting with them.

Excluding all this from consideration has impoverished economics. This has not worried most of the model-builders, but some have made attempts to bring such matters back into economic analysis. They are usually introduced under the heading “consumer choice.” To all but the true believers, this has looked contrived and unpersuasive, often comical. The point is not to deny that people are often calculating and self-interested, as economists claim. It is rather that these impulses are much more constrained, and more limited in their scope, than economists recognise.

Samuelson believed he had transformed economics into a practical policy science. But the policy recommendations of economists are highly predictable – and not because they are solidly based on irrefutable facts. Free markets and a competitive pricing mechanism are defined as the basis for rational behaviour, and all other considerations excluded. From this starting point, no honest person could reach any conclusion other than recommending removing obstacles to market exchange and perfect competition. The evidence gathered in support of this may or may not be convincing, but in any case the conclusion flows from the fictional premises.

Having excluded social relations between people, and relations between humanity and nature, from their analysis, modern economists cannot say much that is useful on social or environmental issues. When confronted with demands based on social or natural priorities that constrain market-based individual choice, the usual response is to denounce these demands as “irrational.” A more enlightened response is to devise ways of turning these demands into new markets.

There is plenty of room for disagreements among modern economists. These generally boil down to tensions between those who are more pragmatic and those who are more dogmatic in their commitment to free-market principles.

THE FINANCIAL TIMES honoured Samuelson for turning economics from a scattered collection of insights into a social science. That is what he aspired to, but not what he actually achieved. Modern economics has often been narrow-minded, abstruse and arid. It mimics the appearance of hard science, without the substantive content.

Samuelson actually divorced economics from social science. His real achievement was to turn it into an ideology of management. The image of the rational calculating decision-maker operating in free markets remains at its core. But this is used less and less to describe how people actually behave, and more and more to prescribe how they ought to behave.

At its worst, economics as a management ideology dogmatically prescribes free-market solutions for every conceivable problem. There was plenty of that at the height of the neoliberal era. The financial crisis made it clear that free-market mantras, even when backed up by sophisticated computer tools, are no substitute for intelligence, experience and common sense – as Samuelson himself had been warning.

Yet economics as a management ideology continues to flourish after the global financial crisis, and for good reasons. At its best, it encourages decision-makers to be as rational as they can – to consider their options more carefully, systematically, and on the basis of evidence. These are considerable virtues. There is little doubt that the spread of economic analysis has generally improved the quality of business management and government policy-making compared to that prevailing before Samuelson. Ironically, it was precisely these virtues that were undermined by neoliberal zealotry, and in the wake of the neoliberal debacle they are needed more than ever.

Yet even at its best this ideology has characteristic weaknesses. Its adherents are too prone to assume that the future can be accurately calculated. Their predictions are invariably wide of the mark. Adherents of this ideology have an inordinate faith in numbers. They usually ignore evidence that is not quantitative, and this is often crucial. Its adherents take a simplistic view of human motivation. Often they solve complex budgetary problems, only to discover they have created totally unanticipated “people problems.”

These strengths and weaknesses are deeply rooted in Samuelson’s approach to economics. He was the key architect of the ruling ideology of our time. Communism could not compete with it, social democracy survived by surrendering, religion is in retreat. Under the banner of postmodernism, cultural critics are trying to survive by hiding behind clouds of obscurantism.

The kings of old surrounded themselves with priests, soothsayers and astrologists. In the modern world, political leaders rely instead on armies of economic advisers equipped with the latest laptops. Paul Samuelson was their prophet, the author of their bible, and the designer of the tools of their trade. •