Regardless of its eventual success or failure, Nine’s proposed acquisition of Fairfax marks a new discontinuity in the Australian media landscape. The law that would once have prevented it was changed last year: now, the political economy and culture of our media are suddenly fluid. The familiar cast of Australian media characters, with their ancient rivalries and discontents, will soon be different, and some venerable figures won’t be there. What is happening is at once startling, unsettling, long anticipated and entirely unresolved.

Reminding us that the media is still a place where very different commercial, civic, political and cultural worlds coexist and sometimes collide, the understandings and expectations of key players and observers vary dramatically. Where Fairfax CEO Greg Hywood sees a merger, the Australian sees the death of Fairfax. Journalists and academics see a new challenge to diversity and democracy. Paul Keating sees Nine’s toxic tabloid culture metastasising, while the government tells a story about ensuring the long-term health of Australian media businesses. So far the stock market hasn’t shared the government’s confidence, with Nine shares falling since the deal was announced, reducing the value of the offer.

In recent days these differences over the significance and implications of this moment of change have taken a sharper form. When the deal was announced, the prime minister welcomed the news. He acknowledged that the agreement required the approval of the Australian Competition and Consumer Commission, but said that the parties expected “no regulatory hurdles.” Market analysts have generally signalled that they expect no major obstacles.

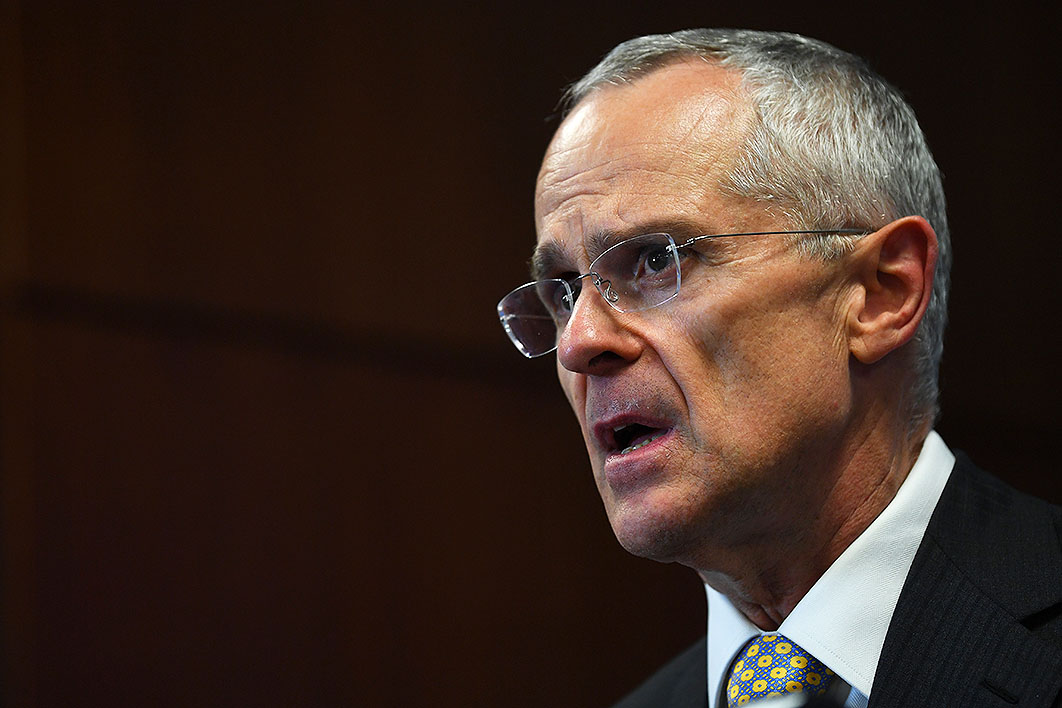

It’s true that the ACCC has a record of approving recent media mergers. But was there an echo in the PM’s remarks of his famous declaration last year that “the High Court will so hold,” with an equal potential for trouble? The media law changes were necessary for the formulation of this merger, but they are not sufficient to guarantee its success. Rod Sims, chairman of the ACCC, has now laid out the regulatory process in plain terms, talking about a vigorous, twelve-week review with the scope to be much more than perfunctory acquiescence. “Of course the merger parties say there are no competition issues. They always do. Every merger I have ever come across, the merger parties said ‘why do you bother us, there are just no competition issues,’” he was reported as saying.

Sims, who is about to enter his last year heading the ACCC, talked about the issues likely to arise for the commission, and signalled some interesting questions, none of which have been addressed by the government, or by the proponents of the deal. The ACCC’s job will be to determine whether the Fairfax acquisition will substantially reduce competition in media markets: on the face of it, a dry exercise in technocratic calculation.

But competition in media industries also raises public-interest issues of diversity, localism and quality that have not been squarely addressed by the government or the two companies. Media businesses often deal not just with one market for their work but with at least two, because both advertisers and viewers are, in different ways, consumers of their products.

So the ACCC must gauge the effects of the acquisition on viewers, advertisers and possibly content providers as well. It will look particularly at where the activities of Fairfax and Nine overlap — those areas, especially news, local information and advertising, where competition might be reduced by the takeover. It can look at evidence not only about the national market but also in relation to specific local and regional markets.

Nine has already raised the question of whether regional media will have a place in the new conglomerate. In Newcastle, for example, the network controls the local NBN TV station and Fairfax owns the Newcastle Herald. Here, measures of competition turn out to be closely linked to questions of concentration and diversity. If competition lessens, the reductions in service that follow may well mean losing different voices. For the same reason, the quality of media services will also be an important consideration.

The market for advertising has been dramatically transformed and expanded by the emergence of Google, Facebook and mobile media, but journalism is another story. The point is often made that readers and viewers now have ready access to more sources of news than ever, but fewer journalists are generating local news. Online-only publications, such as BuzzFeed and Guardian Australia, are important new sources, but they don’t aim to provide the detailed city-based coverage we find in Fairfax’s metropolitan mastheads, and they certainly don’t offer consistent regional reporting.

One organisation that does provide a journalistic alternative, and does cover regional Australia to the degree its reduced budget allows, is the ABC. The ACCC could find that the ABC’s coverage provides an ongoing alternative to Nine/Fairfax news. If that was then a reason for the ACCC not to oppose the merger, Australia’s public broadcaster could find itself underwriting the government’s objectives in the commercial media sector. The position is complicated by the fact that the minister, at the request of One Nation, is conducting his own ad hoc review of the competitive impacts of the ABC, responding to the claims of companies including Fairfax that its online presence undermines commercial media.

The interactions between Mitch Fifield’s inquiry, now due to report, and that of the ACCC will be interesting. The virtue of the ACCC review will be its public process, grounded in well-established institutional, legal and regulatory conventions. These provide some much-needed protection, real and perceived, from immediate political and business imperatives. The ACCC’s processes allow for the consideration of viewers’ and readers’ interests. Like all regulators and policy-makers in this area, though, it faces the difficulty of predicting outcomes in an industry where digital disruption has moved faster and further than in almost any other area, and where the investment in automation and artificial intelligence is intense. Blockchain and other emerging technologies are likely to bring about further changes in journalism and advertising.

Just as we are now making decisions about what we call “legacy” media businesses on the basis of old policy arguments, so our knowledge of the sector is also struggling to answer questions about how we gauge the volume and significance of local, regional or national content on internet platforms. The current moment is demanding bold assumptions from regulators, industry and policy-makers. ●