The story of working-class chancers who parlay a great talent into fame and fortune is a well-thumbed parable of English popular culture. Maybe because it’s so rare.

Charles Dickens started his working life as a child in a rat-infested factory making shoe polish, but because he wrote A Christmas Carol, he eventually got to meet Queen Victoria. The Beatles sang songs so addictive to the ear they could pay cash for their psychedelic Rolls Royces. David Beckham made soccer balls bend to his will and ended up marrying a Spice Girl.

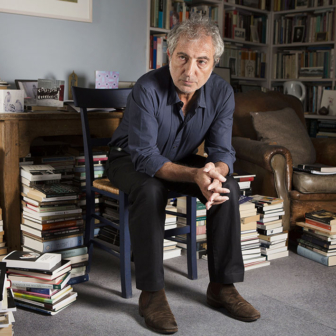

The Trading Game: A Confession is a memoir in the same tradition. It tells the story of a man named Gary Stevenson who traded foreign exchange for Citibank with such skill that he became a multimillionaire before he was thirty.

How Stevenson got from the bottom rungs of the English class system to the clouds at the top of the ladder is partly a story about the making of money. But the bigger part of The Trading Game deals with what it cost him personally, and what he learnt from it.

Ascending the English class system is notoriously vertiginous. As his fellow talented chancer John Lennon once famously wrote:

There’s room at the top they are telling you still.

But first you must learn how to smile as you kill.

If you want to be like the folks on the hill.

A working-class hero is something to be.

As a boy in the 1990s Stevenson played football on the rundown streets of Ilford, a poor suburb in East London. In the cold grey of dusk, before he was called in for dinner, little Gary could see the huge, illuminated glass towers of Canary Wharf hovering in the distance. These temples of commerce twinkling on the horizon of his world were places of some wonder to the young Stevenson. That’s where the money was made.

Stevenson can’t write hit songs or bend it like Beckham: his talent is for numbers. Despite getting expelled from school for selling marijuana, the young maths whizz won a place at the prestigious London School of Economics. But he didn’t fit in with the smartly dressed sons and daughters of the global elite sent to the LSE by their rich and powerful parents. His father worked for the Post Office. He wore trainers and tracksuits to classes. He never bothered to change his accent.

In his lectures Stevenson learnt about Pareto Optimality and Polynomial Equations. But the real lesson the LSE imparted was more brutal. “A lot of rich people”, writes Stevenson, “expect poor people to be stupid.”

On campus one day, Stevenson learns that Citibank is hosting a competition called The Trading Game. Designed to uncover potential talent, the game tests for two things: maths ability and chutzpah. Stevenson, who possesses both, knows he’s in with a chance. The prize — an internship on the trading floor at one of capitalism’s biggest predators — is tantalising to a young man with no contacts in the City. So how does Stevenson do? To borrow a working man’s phrase, “he shat it in.”

In 2007, at the age of twenty, Stevenson rides the lift up one of those Canary Wharf towers as a freshly minted intern. He is a baby giraffe among the jackals.

He observes his frightening new workmates with a mixture of awe, incomprehension and wariness. Men in beautiful suits get hammered in expensive Japanese restaurants. Men in shirtsleeves and loosened ties shout arcane jargon into headsets. With the competitiveness of coked-up rugby players they all gallop towards their enormous yearly bonuses.

Luckily for him, Stevenson is a quick study. He survives, then thrives, in the Kingdom of the Traders while also remaining strangely detached. He eats sushi for the first time and gets drunk a bit (though he doesn’t partake in the cocaine culture). He lives plainly and remains friends with his mates back in Ilford.

You see, our hero has a cunning plan. He will become Citibank’s top trader, pull in his share of the poker chips, and then retire from the table a wealthy young man. And soon enough, the misery of millions presents him with the greatest opportunity of his life.

Stevenson had a mentor on the Citibank FX trading floor. The mentor, who he calls Billy Thomas, had an unusual habit. Heading home after a big night out (of which there were many), this well-dressed plutocrat would get his black cab to pull up on Threadneedle Street. While the meter ran, he’d nip into a quiet side street and risk arrest by taking a slash on the wall of the Bank of England.

So why the midnight micturition? Well, Billy was offended that the Old Lady continued to predict a bright economic future when all he could see was impending darkness. In the early 2000s, while the central bankers had been back-slapping each other for keeping inflation down, Billy had become convinced they’d neglected the bigger picture: the global economy was on the verge of capsizing due to excessive debt in all the wrong places.

For some years Billy had taken a very brave “position” in the market. He was betting the central banks were wrong and he was on the money. In the meantime, all he had to do was hold his nerve and wait — and take the occasional midnight piss on one of the world’s most respected central banks.

In 2008, the year Stevenson became a fully fledged trader, Billy Thomas had the pleasure of being proved very right indeed: capitalism went into cardiac arrest. The subprime mortgage market in the United States crashed and burned. The conflagration spread across the world’s banking sector. Venerable Wall Street firms like Lehman Brothers were engulfed.

And, just as Stevenson’s weak-bladdered colleague had hoped, the rates in the ninety-day lending market evaporated while the less risky one-day lending market remained relatively intact. Billy made tens of millions of dollars in a single week because of this crisis-induced change in the operation of the markets. As Stevenson writes, “Making money trading is not about being right. It’s about being right when everyone else’s wrong.”

Stevenson missed this windfall, but he wasn’t going to miss the next one. Like his fellow Citibank traders he was soon betting that the world’s central bankers would be forced to drop interest rates like a hot brick plucked from a burning house in their desperation to defibrillate a faltering world economy.

The more the economic news turned bad for ordinary people (like Stevenson’s friends and family), the more he and his fellow traders raked it in. Misery loves company — and Citibank FX traders, it seems. To borrow another phrase: they’d “been hit in the arse by a rainbow.”

Soon our hero is trading hundreds of millions, making tens of millions in profits for his bosses, and banking millions in bonuses. The money is great, but the job is killing him. He buys an expensive apartment overlooking the Thames but can’t find the energy to furnish it, so he sleeps on a mattress in the otherwise empty living room. He’s stressed, depressed and unimpressed with the morality of the world he’s found himself in.

Stevenson had come to understand that “the economy” doesn’t necessarily allocate capital to the most productive enterprises, as his LSE textbooks once taught him; it pretty much operates in favour of the rich — like him.

“That’s how it would go. It would get worse and worse. It would grow, it would grow out of control,” he writes. “It wasn’t a crisis of confidence. It wasn’t the fucking of the banking system. It wasn’t an ‘exogenous shock to consumption savings preferences.’ It was inequality. Inequality that would grow and grow.”

Stevenson left Citibank in 2014 after a bruisingly Kafkaesque battle over his final, mammoth bonus. The billion-dollar bank resented their top trader flying the coop with a golden nest egg.

Though he doesn’t write about it in The Trading Game, Stevenson is now an inequality activist and supporter of Millionaires for Humanity, which advocates in favour of a wealth tax.

“Why did no one see it coming?” This was the late Queen Elizabeth’s zinger of a question to practitioners of the “dismal science” back in November 2008, six weeks into the global financial crisis.

Economics might be dismal, but it’s not really a science, even though it continues to advertise itself as one. Princeton University’s emeritus professor of economics, Nobel Prize laureate Angus Deaton, knows this as well as anyone. In a recent essay for the International Monetary Fund’s online magazine Finance and Development, of all places, he took his profession to task.

“We are in some disarray,” he wrote. “We did not collectively predict the financial crisis and, worse still, we may have contributed to it through an overenthusiastic belief in the efficacy of markets, especially financial markets.”

Deaton wonders out loud about the absence of philosophy and ethics in modern economics: “We are technocrats who focus on efficiency,” and by emphasising efficiency above all other values “our recommendations become little more than a licence to plunder.”

Most radically, this much-lauded elder of the profession says that economics, to its detriment, ignores the role of power in economic relationships. “Without an analysis of power,” he says, “it is hard to understand inequality or much else in modern capitalism.”

When he left Citibank Stevenson returned to the study of economics by doing an MPhil at Oxford. As a former highly remunerated cog in the machine of capitalism, he found the course less than useful. Maybe he should sign up to do a doctorate at Princeton with Professor Deaton. •

The Trading Game: A Confession

By Gary Stevenson | Allen Lane | $36.99 | 432 pages