Australian-born lawyer Philip Alston has held senior roles at the United Nations for more than thirty years, dealing with human rights, children’s rights, extrajudicial executions and other issues. From June 2014 to April 2020, he served as UN special rapporteur on extreme poverty and human rights, with a mandate to give “greater prominence to the plight of those living in extreme poverty and to highlight the human rights consequences of the systemic neglect to which they are all too often subjected.”

In that capacity, Alston wrote a series of searing reports, including some highly critical of the United Nations itself, and its agencies. In one, he charged that “if the United Nations bluntly refuses to hold itself accountable for human rights violations, it makes a mockery of its efforts to hold governments and others to account.”

Alston’s most recent report to the UN Human Rights Council, The Parlous State of Poverty Eradication, is in similar vein. “The world is at an existential crossroads,” he writes, “involving a pandemic, a deep economic recession, devastating climate change, extreme inequality and an uprising against racist policies.” Underlying all these problems, he adds, is “the longstanding neglect of extreme poverty by many governments, economists and human rights advocates.”

Alston’s report challenges what he calls “the mainstream pre-pandemic triumphalist narrative” that “extreme poverty is nearing eradication.” Such claims rely on the World Bank’s international poverty line, he says, which is currently set at US$1.90 per day in 2011 prices and converted into other currencies with adjustments to reflect “purchasing power parity,” or PPP.

The World Bank’s poverty baseline is derived from the poverty lines used in fifteen of the poorest countries in the world (most of them in sub-Saharan Africa). For Alston, that represents a “staggeringly low standard of living, well below any reasonable conception of a life with dignity.” US$1.90 in 2011 prices is equivalent to A$2.31 in today’s Australian dollars (converted at PPP), or A$16.20 per week. That’s well below Australia’s Henderson poverty line of A$542.90 per week for a single person, for example, or A$1109.75 for a two-parent household with two children. And it’s less than half the former Newstart allowance of A$40 per day, which is regarded as inadequate across the political spectrum.

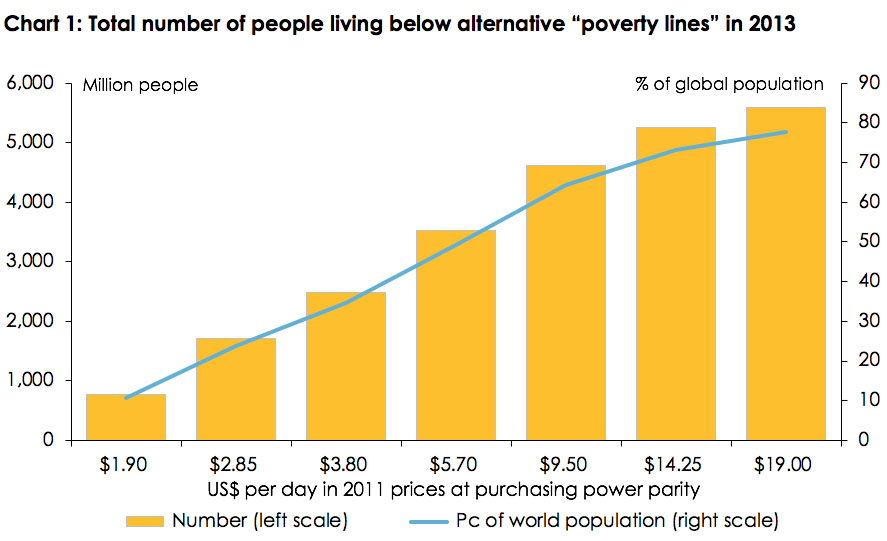

Alston is hardly the first to make this point. Ten years ago, for example, the Nobel Prize–winning economist Angus Deaton gave a lengthy and detailed critique of how the World Bank’s measure was compiled and how it is used in comparisons between countries (and especially between “rich” and “poor” countries). Three years ago, in a presentation to an event hosted by Oxfam at Tasmania’s Government House, I observed that the proportion of the world’s population living in poverty was much higher, and had fallen by much less, if one used higher (but still very low) poverty lines than the World Bank’s preferred measure (see Chart 1).

Alston makes the point, as I also did in 2017, that most of the claimed reduction in global poverty is attributable to China. Exclude its 1.3 billion people, he says, and “the global headcount under a US$2.50 line barely changed at all between 1990 and 2010.” And if all of East Asia and the Pacific are excluded, “the number of people living in poverty would have increased from 2.02 billion to 2.68 billion between 1990 and 2015 under a US$5.50 line.” (US$5.50 per day in 2011 prices is equivalent to A$6.70 per day, or A$46.89 per week, in contemporary Australian dollars.)

Source: The World Bank, Povcalnet.

Based on more realistic measures, Alston says, “the world is not even close to ending poverty.” More than that, he points to two reasons why the number of people living in poverty is likely to increase rather than decline.

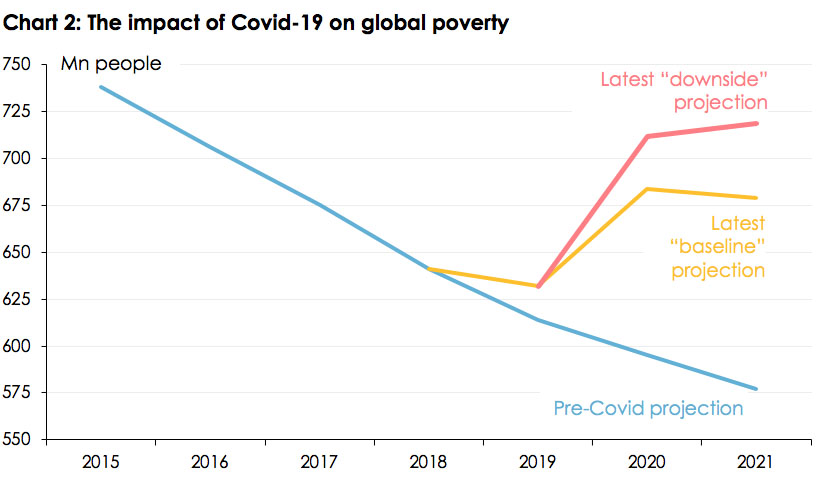

The first of these is climate change, which the World Bank has acknowledged could “force more than one hundred million people into extreme poverty by 2030.” And the second, of course, is Covid-19, which the World Bank last month estimated could push between seventy-one million and one hundred million people into extreme poverty, using the US$1.90 a day benchmark (see Chart 2). Using more realistic benchmarks, the impact is much greater: at US$5.50, for instance, the estimated number of people pushed into poverty is between 177 million and 233 million.

If the UN’s first Sustainable Development Goal of “an end to poverty in all its forms everywhere” is to be achieved by 2030, Alston believes five things must be done.

First, he says, we need to “reconceive” the relationship between economic growth and the elimination of poverty. “In too many cases,” he argues, “the promised benefits of growth either don’t materialise, or aren’t shared.”

Second, he asserts that a “significant redistribution” of income and wealth within countries (as distinct from among them) is “indispensable” if “extreme inequality” is to be reduced. To back this up, he cites a recent World Bank working paper’s conclusion that “reducing each country’s Gini index” — a widely used measure of inequality — “by 1 per cent per year has a larger impact on global poverty than increasing each country’s annual growth [by] one percentage point above forecasts.”

Third, he argues for taxation to be “front and centre in any set of policies to eliminate poverty,” both as “a symbol of solidarity and burden-sharing, and as a reflection of a deeper set of values.” In support of that aim, he suggests that governments “should publish income, wealth, and effective tax rates of top earners, and require multinationals to publish country-by-country reporting data.”

Source: Daniel Mahler et al., “Updated Estimates of the Impact of COVID-19 on Global Poverty,” The World Bank, 8 June 2020.

Fourth, he asserts the necessity of “large-scale debt forgiveness” (that is, waiving loans made by high-income countries and international financial institutions to low- and middle-income countries), especially in the wake of Covid-19. Members of the G20 (of which Australia is one) agreed in April to suspend until the end of this year debt service payments totalling US$11.5 billion on “official” debt owed by seventy-six of the world’s poorest countries. That doesn’t affect the US$13 billion owed to private sector creditors, however, and falls well short of outright forgiveness.

Finally, Alston calls for “universal social protection,” something he says is “incompatible with the ‘neoliberal’ policy prescriptions that shape the overall approach of the international financial and economic regimes” and at odds with the “austerity policies which have dominated much of the landscape since 2010.”

Rather than relying on the private sector to do all this — which Alston calls “a blind alley” — the role of government needs to be “centred.” He is particularly critical of the role played by “billionaire philanthropists,” claiming that they “jeopardise governments’ capacity to set priorities… and implement programs,” are “less likely to expose and tackle unjust underlying structures” and represent “a form of private political power… in which wealth can dictate policy without regulation or accountability.”

Instead, he says, “governments need to listen more attentively” to “people who have experienced poverty” rather than “shutting them out of policymaking processes.” An “urgent first step” would be to replace the World Bank’s poverty line with “the goal of realising the human right to an adequate standard of living,” as indicated by “a broad dashboard of multidimensional indicators that reflect modern expectations of a life free of poverty.”

Alston’s report is written with eloquence, reason and passion, but it doesn’t really say anything that hasn’t been said by many others before. And it is addressed to an organisation, the UN Human Rights Council, that has failed to do much more than “tick boxes,” as Alston implicitly acknowledges, has long been chronically mismanaged and, in the words of one observer, has become “a kind of refuge for officials involved in serious corruption cases.” It is difficult to conceive of the United Nations ever successfully tackling global poverty (or any other issue) if doing so runs counter to the perceived self-interest of one or more of the five nations possessing ultimate veto power.

But that’s not to say that Alston’s report won’t help change the way others think.

Earlier this month, eighty-three millionaires from seven countries (sadly, none of them from Australia) called on their governments to “raise taxes on people like us. Immediately. Substantially. Permanently.” This is necessary, they said, to solve problems “caused, and revealed, by Covid-19” that, in their view (like Alston’s), “can’t be solved with charity, no matter how generous.”

The OECD this month released new data highlighting “the misalignment between the location where profits are reported and the location where economic activities occur,” with multinationals in “investment hubs” reporting “a relatively high share of profits compared to their share of employees and tangible assets.” To some, that will be a (re)statement of the bleeding obvious: but it precisely fulfils Alston’s third recommendation and strengthens the evidence base for the OECD’s efforts to combat tax base erosion and profit shifting.

But it has long surprised me that one way governments could strengthen the revenue base of low- and middle-income countries is almost never mentioned by anti-poverty advocates. It is also conspicuously absent from Alston’s report. And that is to remove the longstanding barriers that face those countries’ exports to rich countries and abandon policies that artificially depress the prices they receive for the products they do manage to sell on global markets.

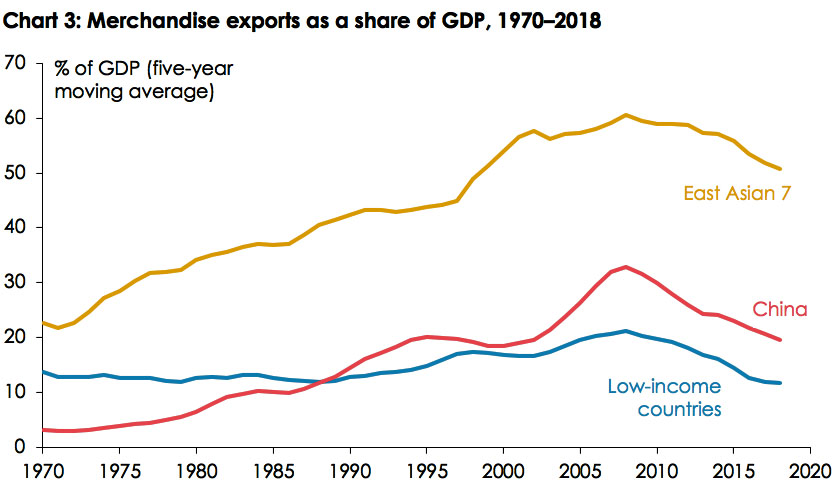

The East Asian states that successfully moved from low-income to middle- or high-income status by the end of the twentieth century did so largely through exports (Chart 3). One of the hallmarks of countries that have remained in the low-income category has been their inability to raise their national incomes — and thus the living standards of their people — in the same way. Indeed, the share of low-income countries’ GDP derived from exports of goods has been lower over the past five years than it was during the 1970s.

In some cases that’s largely the result of poor choices by the governments of those countries. But in many others it at least partly reflects rich countries’ restrictions on imports of the products that low-income countries specialise in, or rich countries’ subsidising of the production of commodities in which they don’t have any particular comparative advantage. Both practices have depressed the prices received by low-income producers on world markets.

Since 2009, according to the Centre for Economic Policy Research’s Global Trade Alert, rich countries have implemented almost 6000 measures considered “harmful” to international trade but fewer than 900 “liberalising” measures.

Note: “East Asian 7” are Korea, Hong Kong, Singapore, Malaysia, Thailand, Indonesia and the Philippines.

Source: The World Bank; author’s calculations.

While more of these harmful measures have been directed at China than at any other single country, Global Trade Alert says that more than 40 per cent of them are harmful to countries classified as low-income by the World Bank. Some 393 of them were directly harmful to India (which, it should be acknowledged, has been quite diligent in pursuing harmful trade policies itself); 236 were harmful to South Africa; more than one hundred were harmful to each of Honduras, Guatemala, Costa Rica and the Dominican Republic; and twenty-seven were harmful to Madagascar, one of the poorest countries on Earth.

According to OECD estimates, OECD member countries have spent US$2.4 trillion over the past decade subsidising agricultural production (of which the European Union accounted for US$1 trillion, Japan US$419 billion, the United States US$357 billion, Switzerland US$64 billion, Canada US$49 billion and Norway US$36 billion). This compares with US$1.4 trillion in official development assistance to developing countries by the governments of the twenty-four members of the OECD’s Development Assistance Committee.

One of the principal side effects of these massive subsidies is to push down the prices of subsidised products, especially when production exceeds what can be sold in rich countries and the surplus is dumped on global markets.

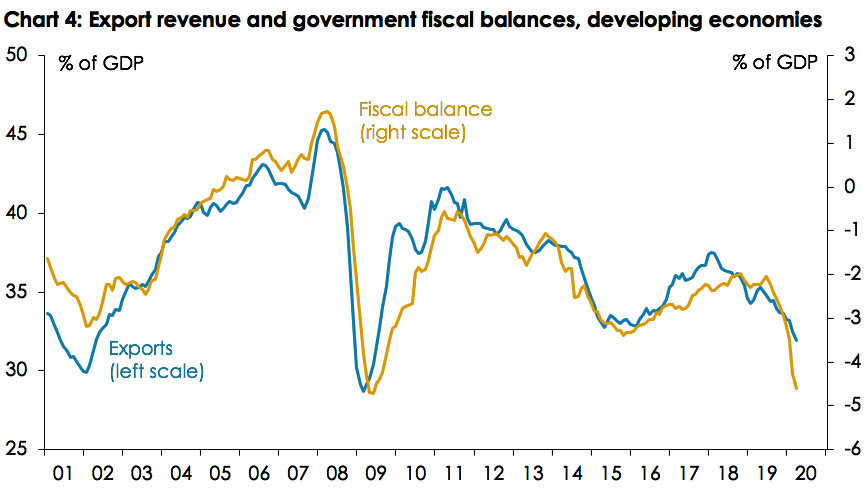

That, together with other discriminatory trade measures enacted by rich countries, deprives the governments of developing countries of revenue that they could have used to provide more or better services for their citizens. As Chart 4 shows, developing economies’ export earnings and their fiscal positions are strongly correlated.

And yet nowhere in his report does Alston call attention to the impacts that the trade and agricultural policies of rich countries have had in entrenching global poverty, or plead for major changes to those policies.

Note: Data are shown as six-month moving averages.

Source: Jonathan Anderson, MMT and Emerging Markets, Emerging Advisors Group, 14 July 2020.

He’s hardly Robinson Crusoe in that regard: nor does one ever see protesters outside gatherings of leaders or ministers of rich countries chanting or holding banners and placards demanding changes to the trade or agricultural subsidy policies that do so much harm to the world’s least-developed countries.

On top of this, there is a risk — which Alston doesn’t mention in his dire warnings about the likely consequences of Covid-19 — that rich countries will adopt trade policies even more inimical to the interests of developing economies in the name of “greater self-sufficiency” in “strategic products.”

It’s one thing for rich countries, including Australia, to want to reduce their dependence on a single supplier for personal protective equipment, or medicines. But that shouldn’t be used as an excuse to favour local production (which could be just as vulnerable to interruptions from natural disasters or industrial accidents, for example) over imports — especially from poorer countries. Nor should it be used as an excuse to take an unduly expansive view of what products should be designated as “strategic.”

Moreover, given the dire condition in which the pandemic (and the consequent recession) is likely to leave the public finances of rich countries, any success that rich-country governments are likely to achieve in mobilising public support for increases in taxation is likely to be applied to domestic needs rather than the needs of those in the world’s poorest countries — much as people of good will, including Alston, might wish it were otherwise. •