All of Australia’s major cities have expanded rapidly in recent decades, with much of the necessary new housing added on the cities’ former fringes. Poor planning has left many of these suburbs without adequate public transport — so much so that a worker who lives on Sydney’s newly populous fringe and works in or near the CBD can spend as much as 15 per cent of an average after-tax salary on toll and parking costs. State governments are now playing a costly game of catch-up.

As well as rising mortgage costs, families on the fringes face steep increases in energy prices. Across most of Australia, the wholesale price of electricity has more than tripled in the past two years; retail prices have followed, and are generally double or triple what they were two years ago.

A big contributor to those cost hikes is the price of gas, which has risen sharply as a result of Russia’s invasion of Ukraine. As one of the world’s largest gas exporters, Australia had been immune to such risks because of its plentiful local supplies. But we lost that immunity after 2015 when large-scale exports from the east coast led to domestic scarcity and the imposition of global pricing. The looming rundown of Victoria’s big Bass Strait gas fields poses a further risk to supply and prices.

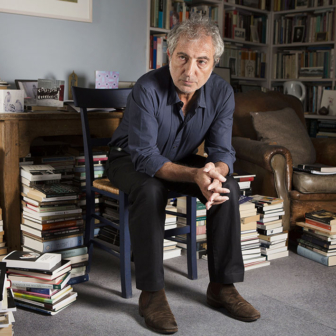

High commuting costs, like energy market failings, result from poor planning. But they have another thing in common: transport and energy infrastructure are often financed by pension funds rather than governments. The people who administer these funds are the subject of political economist Brett Christophers’s new book, Our Lives in Their Portfolios: Why Asset Managers Own the World. These asset managers, he writes, “increasingly own and control our most essential physical systems and frameworks,” and their financial priorities are not aligned with social priorities unless governments impose that requirement.

While his style is somewhat dry and a little didactic, Christophers highlights three tendencies that raise big questions about how we finance infrastructure: the investment priorities of pension funds often determine which infrastructure projects go ahead; governments often take on risks that should belong to investors; and the conditions imposed by one infrastructure project can corrupt the process of providing public services or assets.

Christophers probes these interactions of public and private interests in detail. But I’m not sure he has stepped back to see the bigger picture. For starters, these investments aren’t big enough to justify the suggestion that asset managers rule society. Assets under management might total as much as US$1 trillion, he says, but that’s less than a third of the infrastructure investment undertaken last year by the fifty or so largest economies in the world.

The pension funds need reliable, predictable income to meet their obligation to pay regular returns, and the fees charged by proven asset managers are correspondingly generous. It’s no coincidence that the pioneering firm, Macquarie Bank, is called the “millionaires factory.” Macquarie, adept and innovative, has found new ways to skim earnings from unlikely places.

Asset management took off after the global financial crisis, partly because some assets — housing in the United States being the prime example — became relatively cheap and yet still offered good rental income. In the aftermath of the crisis the world was seemingly awash in savings; as interest rates fell, infrastructure assets became much more attractive to big investor organisations.

Christophers is inclined to focus on the incidental pitfalls of the asset managers’ investment in essential infrastructure rather than look at the design of the system that encourages this kind of asset. In many cases, these managers are standing in for governments. They raise money, just as governments do. Once an investment in a road or a tunnel or a power generator has been made, they generally manage the asset just as a statutory authority or government department would — or they outsource that function.

This form of asset management is created by government. Because the assets are often singular — a freeway or tunnel required to meet social needs — governments own the project from the start and set the terms. Asset managers often, perhaps always, get near-monopoly rights, and the primary tension between them and government is usually price.

What is this monopoly worth? If governments get that wrong, they miss out on some, or even a lot of, cash. If investors get it wrong, they don’t make much money — or sometimes go broke.

Interestingly, Christophers doesn’t examine two other fundamental questions: why roads are financed using tolls, and how better government might deliver more equitable and efficient results. And though politics can be heavily influenced by real estate interests, he leaves property-sector influence in Western economies largely unexamined.

Our Treasury officials carry on quite a bit about rent-seeking by industry, but rarely do you see much pushback when developers demand taxpayer support as they convert broad acres into housing, often kilometres from schools or hospitals or even shopping centres. Looking back on the recent history of urban expansion, it’s fair to ask whether urban planning is extinct.

Poor planning exaggerates demand for some assets, like outer-urban freeways, that neatly fit the economic interests of asset managers. But you can’t blame asset managers for that. They might, however, have contributed to the illusions that have led governments down hazardous paths.

How did we get here? Australia’s economic debate has evolved over many years. In the decades after Federation an accord between capital and labour manifested in the Harvester judgement — our first national minimum wage — and relatively high levels of industry protection. During the 1970s and especially the 1980s a more laissez-faire consensus emerged, opening Australia up to trade, among other things, and sharply increasing the role of finance.

Once-passive pension funds, closely aligned with employers, became active investors largely driven by arithmetic. Asset trading became a big driver of Australian economic activity. And politicians became unused to thinking about public investment in any sector where business might have a role, even when the involvement of business depends on government.

One example Christophers highlights is renewable energy. He notes that asset managers haven’t much interest in large-scale traditional power stations, which are too complex and risky. He suggests that the set-and-forget nature of solar cells and wind turbines has attracted very big players to the energy transition. Government-backed purchase agreements are undoubtedly a factor, too, providing taxpayer assurance of investment returns.

One challenge of the energy transition derives from the fact that the energy itself is only part of the price consumers pay for electricity or gas. A cursory look at a typical electricity bill reveals that the supply charge is large relative to the price of the energy consumed. This charge is largely made up of the cost of wires, poles and maintenance, a monopoly activity delivered by privately owned companies largely in the hands of asset managers.

Less transparently, energy is only partly priced by markets. Australia’s National Electricity Market is good at pricing the least-cost source of power at any time of day, effectively delivering a competitive outcome. But consumers expect power when they flick a switch, and that level of reliability depends on investment in generation that isn’t needed all the time. This raises a challenge for the energy transition, and it cannot be resolved by the NEM.

The electricity supply Australians have today was built almost exclusively by state governments. Over time, New South Wales and Victoria sold power stations and other elements of their state energy authorities to private owners. In general, much of the money raised has been redirected to other infrastructure. Only Queensland and Western Australia still have a public power utility — though Victoria intends to resurrect the State Electricity Commission and the new NSW government has indicated it might have similar plans.

So far, though, state governments have been unwilling to deal in any concrete way with the reliability part of electricity supply. Yet the crucial question, occasionally hinted at by the national regulator, AEMO, but only raised in blunt terms by people like former Snowy Hydro chief executive Paul Broad, is this: will we have seriously unreliable power during the transition?

Without going into the specifics, the key point is that our power supply is a basic service that we experience in a certain way because of choices made decades ago, mostly by state governments. Today’s governments don’t appear to accept that part of their role is to ensure the next system is at least as effective as the old one.

While asset managers are certainly investing in the energy transition in a big way, they are not utilities. In fact, most of them behave more like property speculators, acquiring a right and setting up renewable generation before flipping the asset to a fund.

What seems to have happened since the 1970s is that Australia’s public management has retreated from any activity that has commercial potential, assuming instead that “the market” will deliver the right outcome as long as the “settings” are right.

In the case of power, a debate actually took place about the need for a publicly funded “capacity” payment to ensure that backup power was available for times when the system was not adequately supplied. But the states couldn’t agree. Instead, it was assumed that the very high prices that arise when normal supply is interrupted will encourage private investors to build storage capacity or “peak” gas plants that can be brought on quickly. For a variety of reasons, that latter outcome now seems less likely.

Meanwhile, we are getting good at bringing forward the dates on which the big, concentrated coal-fired plants will close, but less adept at rapidly rolling out the transmission and other investments needed to make sure those closures don’t bring serious problems.

Christophers’s exploration of the remarkable global reach of private asset managers into social assets is interesting and informative. But the other side of the asset management trend is a passivity among governments at a time when demands for active management of public assets are intense and have the potential to rise to unprecedented heights. •

Our Lives in Their Portfolios: Why Asset Managers Own the World

By Brett Christophers | Verso | $39.99 | 320 pages