Tax reform is not for the faint of heart. Any government that takes it on seriously deserves praise for courage. But as the Rudd and Gillard governments showed, courage is prone to desert you under fire, and in any case, successful tax reform requires a lot more than courage.

To make it happen, governments also need very high levels of political skill, social understanding – and ultimately, as John Howard showed in the GST debate, the humility to strike a deal.

Does the Abbott government have that capacity? For that matter, would a Shorten government have it? We shall see.

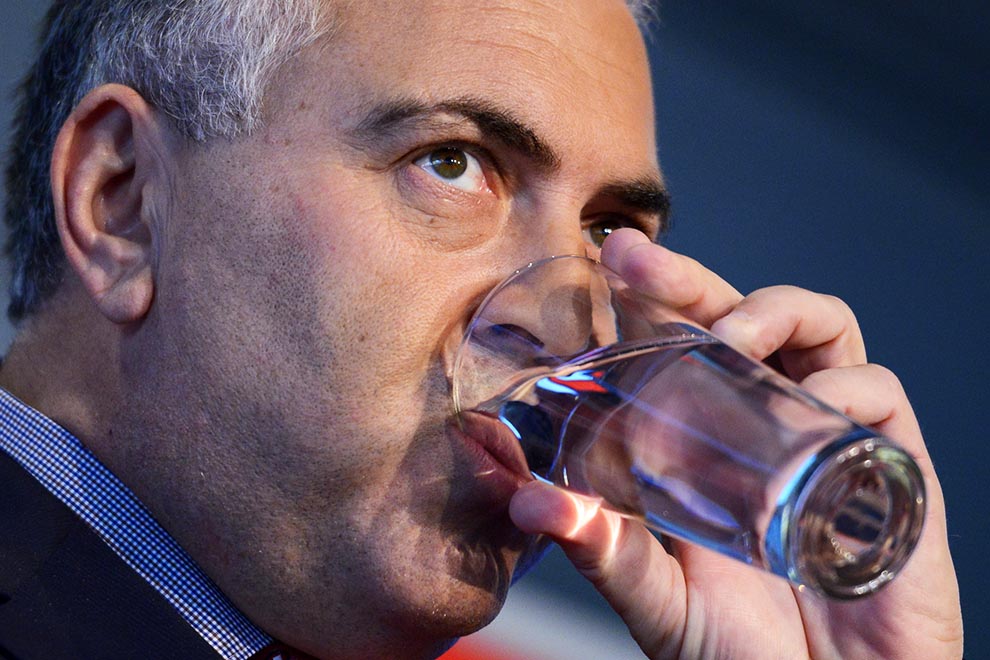

Joe Hockey has always been keen to take on tax reform, and by and large, he is off to a good start with the 203-page Treasury discussion paper he released on Monday. In a relatively short space, it covers an amazingly diverse canvas of issues, for the most part with exemplary clarity and objectivity.

Hockey has learnt from the debacle of Labor’s handling of the Henry tax review – and the contrasting success of the Key government’s approach across the Tasman. Most importantly, he has ruled nothing in and nothing out. Negative gearing, superannuation concessions, a higher and/or wider GST, dividend imputation, work-related deductions, capital gains tax breaks: they’re all there.

Hockey wants us to join in “a national conversation on tax reform.” Treasury’s paper itself nominates sixty-six questions for discussion, and touches on many more. It invites us all to lodge submissions by Monday 1 June. The government will then absorb all these views and come up with an options (or green) paper in the second half of the year. We will be invited to respond again, and then the Coalition – and presumably, Labor and the Greens – will take their policy proposals to the next election.

But beware. While most economists argue that tax reform is crucial to lifting Australia’s economic potential – Ross Garnaut put it at the top of his reform list in his recent book Dog Days – the politics of reform is so difficult that this whole process could end in nothing.

Tax reform is essentially a zero-sum game. Assuming that the government is not aiming to raise less revenue – which would put the budget in even worse shape – it will aim to take an extra dollar for every dollar it gives away. The people who have to pay those extra dollars tend to object, and loudly.

As former treasurer Peter Costello once put it, people don’t think it’s tax reform if they end up paying more tax. The losers in tax reform will complain more than the winners will cheer. That’s the government’s problem.

The only revenue-raising tax reforms that voters support are those that aim to get more money out of business, and the rich. But business these days is pretty good at defending itself (see Tax, mining), which means that tax reform has to be designed so that, at most, only the rich end up worse off.

That rules out a lot of things. For example, business lobbies have been campaigning for an increase in the GST, with the rate increased to 15 per cent (as in New Zealand) and the tax widened to cover at least most consumer spending (the Treasury paper reports that Australia’s GST base has shrunk to just 47 per cent of consumer spending, compared with 96 per cent across the Tasman).

But there are two complications. First, GST revenue goes to the states, whereas company tax goes to the feds. That could, however, be turned into a win–win reform. The federal government could pay for the company tax cuts by cutting tied grants to the states, especially in education and health. The states would instead get much more untied GST revenue, giving them more fiscal independence, and allowing them to run their own areas of responsibility as they see fit.

The other complication, however, is that almost any tax on consumer spending will be regressive. Because poor consumers spend all of their income whereas the rich save much of theirs, the GST clobbers the poorer two-thirds of society for a higher share of its income than the shares it takes from those at the top.

That is why raising the GST is politically so hard. It can be fixed, by increasing welfare payments and reducing taxes for lower-income earners, so that those in the bottom two-thirds are not made worse off. But can you recall any Coalition government weighting income tax cuts to favour the bottom two-thirds of income-earners? I can’t.

The headlines on Monday said Treasury was making the case for a higher GST, and shadow treasurer Chris Bowen claimed that this was the whole point of the paper. Bowen must have missed not only its lengthy discussion of the problems with a GST, but also that crucial final paragraph on page 131, which says that the government will consider proposals to change the rate and/or base of the GST “only… if there is broad political consensus for change, including by all state and territory governments.”

Translation: if Labor opposes it, it won’t happen. If the government of the Northern Territory, Tasmania or the Australian Capital Territory opposes it, it won’t happen. On Monday, Hockey all but ruled out changes to the GST. Sadly, that is one reform that is effectively off the table. Many other issues are likely to join it there as we approach the election.

That would be our loss. For, as the discussion paper argues, the right tax reforms could make a future Australia better off by encouraging more people to work and channelling our savings into more productive areas. They could make it fairer by closing the loopholes used disproportionately by wealthy people to avoid tax.

They could give us a tax system that is simpler and easier to comply with: in New Zealand, again, only a third of taxpayers file returns, and business compliance costs are lower than here. And, finally, they could give us a revenue system that is better able to tackle what appears to be a rising tide of transactions, large and small, being shifted offshore into low-tax countries.

In essence, the key thrust of Treasury’s discussion paper is to argue for a tax system that has lower tax rates, both for individuals and for companies, and pays for them by felling the forests of tax concessions, deductions, exemptions and rebates that allow people and companies with good tax advisers to avoid the taxes others are paying.

Its recurring theme is that the tax system should aim for “the right balance between simplicity and fairness.” It should also be efficient – with low collection and compliance costs per dollar raised – and sustainable in this age of digital global transactions, where money is so easy to shift from country to country, and often so hard to trace.

The paper reads as though Treasury has generally been given a free hand to put the arguments as it sees fit. To anyone who has been through previous tax debates, the arguments are mostly familiar. On some issues, Treasury is scrupulously neutral between the rival arguments; on others, you can read a clear preference between the lines.

For example:

• Treasury argues that Australia’s high company tax rate relative to its neighbours is costing us investment, and hence jobs and growth. The paper effectively argues for a significant cut in the 30 per cent rate – but implies that it should be paid for by removing dividend imputation, once seen as Australia’s star example of tax reform.

(Dividend imputation gives a tax break to Australians who hold shares in Australian companies. When BHP, for example, pays company tax to the government, that tax is deemed to have been paid by its shareholders, so their dividends are then tax-free. It was part of the Hawke government’s 1985 tax reforms, but it now costs billions of dollars a year and some argue that it is archaic in a global economy.)

Nicholas Gruen, director of Lateral Economics, first proposed such a trade-off a decade ago in a paper for the Business Council, and it has slowly gained support among economists and in business circles. But will it get support from the Abbott government? Or the Shorten opposition? Hmm.

• The paper is clearly targeting the massive tax breaks for superannuation, which Treasury’s last Tax Expenditures Statement estimated at $35 billion a year, and that excluded the most egregious of them, the fact that people over sixty cannot only take their superannuation tax-free, but also funnel their other income through super to receive it the same way.

Politically, the brave pioneers in this field have been the Greens, who recently commissioned the Parliamentary Budget Office to calculate how much could be saved by replacing the flat 15 per cent tax rate on employer contributions to superannuation with a progressive scale that more or less applies a tax rate 15 per cent below whatever marginal rate the beneficiary is on.

The PBO found that reform would save $10.2 billion over four years, and there seems little reason not to apply the same model to the flat 15 per cent tax rate paid on the annual earnings of your superannuation account. On Monday Bowen expressed support for reforms in this general area, and since most taxpayers would not be hurt by it, something like this probably has a reasonable chance of being implemented.

• Negative gearing is also in Treasury’s sights, although dealt with in surprisingly soft terms. Treasury points out, correctly, that all investors – not just housing investors – are allowed to write off their losses against income from other sources. But it fails to add that no other tax break has done so much social damage, by encouraging investors disproportionately into housing and thereby driving up house prices to levels that price lower-income Australians out of the market.

Frankly, its discussion of the issue is disappointingly shallow. It notes that in every year since 1999–2000, housing investors have reported more losses than profits, but it neglects to add that the tax statistics show two-thirds of housing investors are now claiming losses against tax – almost all, because they claim to be paying more in mortgage bills than they receive in income – and that in the past twenty years, their numbers have almost trebled, while those reporting profitable housing investments have risen only gradually.

The Henry review tried to deal with this subtly, by proposing to limit deductions for losses on all investments to 40 per cent of the loss claimed. Even that was too big an ask for the politicians.

Today there are probably close to 1.5 million Australians using this tax break. The force of their numbers suggests that it is futile to argue that the tax break should be abolished. Rather, the sensible strategy for reformers would be to limit the amount anyone can claim as a tax deduction: say, to $10,000 (which is roughly the average claim).

But beware: the Treasury paper does not hint at any proposal for tackling negative gearing. I would not hold your breath waiting for one.

• Treasury seems far more eager to take on Australia’s most widespread tax deduction: work-related expenses, or WREs. This is, after all, the main reason most of us bother to fill out a tax form. Treasury reports: “In 2011–12, around 8.5 million people claimed WREs totalling nearly $19.4 billion, although around 38 per cent of tax filers had claims of less than $500.”

The paper relates with approval how New Zealand long ago “cashed out” WRE deductions by scrapping them, and giving income tax cuts in return: that’s why so few Kiwis now fill out tax returns. Another option, Treasury suggests, is to allow a standard deduction set at, say, $500, and get rid of all that paperwork. You sense that, one way or another, it sees this area as one where a bold government could find the savings needed to reduce tax rates.

There are literally dozens of other issues canvassed in the paper, but you’ve got the gist of it. Whether the issue is the taxation of business income, or the GST, or payroll tax, or the states swapping stamp duties for a bigger land tax, the thinking behind the discussion paper is that we need to make the tax system simpler, fairer and easier to comply with, and the way to do that is to remove tax breaks and use the money to reduce tax rates.

It’s a good aim. Similar reforms worked well in the United States in the 1980s – the so-called Reagan tax cuts, although President Reagan was actually a late convert to the cause – and they have wide support from economists. Can Joe Hockey or Chris Bowen handle the politics well enough to win wide support for them from the voters? That’s the question now. •