When it comes to housing, Australia and Britain have much in common. Both countries are committed to the notion of a “property-owning democracy,” both see this vision threatened by escalating house prices, and both have responded to the threat in similar ways. Before he won Britain’s 2019 election, Boris Johnson promised the Conservative Party would build “at least” a million new homes in England (since devolution, other parts of Britain have their own housing powers) over the five-year life of the new parliament. In his first budget, Australian treasurer Jim Chalmers made a similar pledge — a million new homes in five years.

They weren’t offering to build or finance these new houses; they want private developers to do that.

Sitting behind these policies is the commonsense view that the key to bringing down the cost of housing is building more dwellings. This accords with our everyday experience of how markets operate: when something is scarce, prices go up, and the best way to bring prices down is to provide more of it.

When it comes to housing, though, the relationship between price and supply isn’t so clear-cut.

We know this partly because we have an alternative to house prices — rents — as an indicator of housing demand. Rents track demand for housing as a service, whereas real estate prices also reflect demand for housing as an investment.

It turns out that rents have risen far more slowly than house prices over the past twenty years (although now they are rising sharply in England and Australia). And despite low wage growth, the average share of household spending devoted to rent has also remained fairly constant in both places.

That’s not to say that rents are affordable, especially for low-income tenants in expensive cities like London and Sydney. If rents were already excessive twenty years ago, they are still excessive today, reflecting a persistent shortage of housing. The point is that rent increases over time have been relatively modest; if the pace of house building had fallen well behind the growth in demand then we might have expected sharper rises.

We know, too, that factors other than supply can have immediate and dramatic impacts on property prices. As interest rates have gone up in recent months, house and apartment prices have dropped back from their 2022 peaks.

Prices tend to go down when it’s harder to get a loan (which is why regulatory authorities tighten bank lending rules when they want to dampen the market). And prices go up when governments stimulate the market with first homeowner grants or tax concessions. The construction industry is also notoriously volatile, so the supply of new homes fluctuates as the number of dwellings completed rises or falls from year to year. What’s more, new homes make up only a small proportion of overall housing stock and real estate transactions, so the impact of construction on prices is slow and muted.

Over time, such ups and downs should even out, revealing the underlying relationship between housing supply and housing demand. So, what does twenty years of census data tell us about the housing challenge in Australia and Britain? Is the core problem that we don’t build enough houses or are other factors also at play?

Australia’s population grew by 35 per cent between the 2001 and 2021 censuses, and the stock of dwellings grew by 39 per cent. England’s population grew by 15 per cent, and its stock of dwellings 17 per cent. In short, in both countries, population and dwelling supply moved roughly in tandem.

Of course, as with rents, if there was already a housing shortage in 2001 then that shortage would have carried through to 2021, keeping prices high. In principle, if we’d built more housing then prices should have come down. Proportionally, though, the scale of the problem has stayed roughly the same, so again, a lack of building doesn’t appear to account for the rapid escalation in real estate prices over the past two decades.

But a simple comparison between population growth and dwelling growth can be misleading, for a number of reasons.

First, housing demand is driven not by the overall number of people but by the overall number of households. This might seem like splitting hairs: average household size has remained roughly constant in England and Australia over the past twenty years, and so the relationship between household numbers and dwelling numbers held steady.

Here things get complicated, though, because in an ageing society, with more people living alone, household size should fall. This means more households overall and a need for more dwellings to accommodate them. In both Australia and England, average household size was projected to fall to about 2.2 people by 2021, but has remained higher.

One view is that the projections were wrong, because they failed to anticipate social changes such as fluctuations in birth rates, falling divorce rates and a preference by some recent migrants to live with extended family.

But perhaps housing shortages prevented the decline in average household size? A lack of housing can induce adult children to stay in the parental home longer than they’d prefer or force two families to squeeze into the same accommodation. The formation of new households is suppressed, and the demand diverted into “hidden” or “concealed” households. According to one estimate, two million adults could be living in concealed households in England.

Linking population and dwelling numbers over time also disguises regional differences. Greater London, for instance, gained more than 1.6 million new residents between 2001 and 2021, but the population of Sheffield hardly changed and remains below its 1950s peak. Barring a new industrial revolution to bring factory jobs back to Sheffield, the demand for housing there is likely to remain relatively flat.

Dwelling growth in the City of Melbourne has far outstripped population growth over the past twenty years thanks to a boom in high-rise residential towers. On census night 2021, a quarter of all the municipality’s homes were unoccupied. Covid alone is unlikely to account for all those empty apartments. Rental vacancy rates in the CBD are significantly higher than the rest of Melbourne.

The population of the City of Hobart, by contrast, has grown faster than dwelling supply since 2001, and the share of unoccupied dwellings was below the national average at the last census. This might help explain why Hobart is the toughest capital city for tenants, with the fewest vacancies and the highest rents relative to income.

So, is it possible that we may have been building enough houses, but in the wrong places? London School of Economics geographer Paul Cheshire blames planning failures for “actively preventing houses from being built where they are most needed or most wanted — in the leafier and prosperous bits of ex-urban England.”

Does his thesis gain more weight if we drill down to a more local level and can compare two local government areas in the same city and the same labour market?

Tower Hamlets, in London’s inner east, and Camden, in the inner north, are in many ways similar. About a third of their residents live in social housing, but both also have pockets of considerable wealth. In 2001, each of the boroughs had a population of about 200,000 people and a comparable population density.

Since then, however, their paths have diverged. Tower Hamlets has gained more than 100,000 residents, while Camden gained only 12,000 (and its population declined after 2011). Tower Hamlets is now the most densely populated local government area in England, home to 112 people per soccer pitch–sized piece of land (as the Office of National Statistics calculates it). Camden has “only” sixty-nine people per soccer pitch.

What conclusions can we draw from this? Perhaps Tower Hamlets council is more pro-development than Camden, and better planning has enabled more dwellings to be built there to accommodate new residents? Perhaps Tower Hamlets simply had more room to grow, with disused industrial sites like the docklands at Canary Wharf available for redevelopment? Or maybe the residents of Camden, which is home to an older demographic, have begun to consume more housing per head of population than their younger counterparts in Tower Hamlets?

Camden has double the share of residents who own their homes outright and more than double the share of households with at least two spare bedrooms. It also has a higher percentage of vacant dwellings than Tower Hamlets, and its residents are far more likely to own a holiday house.

The contrast between the two boroughs highlights a third objection to simple comparisons between numbers of people and numbers of dwellings: demand for housing is a product not just of population but also of income.

As leading British housing economist Professor Geoff Meen puts it, housing demand comes “not just from newly forming households, but also existing households as incomes rise.” In other words, as people get wealthier, they want bigger, better houses as well as second homes and holiday houses. Cheshire says his research shows that a 10 per cent increase in incomes leads people to spend about 20 per cent more on extra space in houses and gardens.

We could express this differently: as the rich get richer they consume more housing; as the poor get poorer, they consume less, to the point of living in severely overcrowded homes or without a home at all. If we look for the roots of the housing crises in England and Australia through this lens, then we might shift focus from the supply of housing to its distribution.

When we do that, the challenge becomes not just to build more housing but to find ways to make its use fairer and more efficient — by altering how housing and land are taxed, for example. More progressive land taxes or capital gains taxes on housing could both redistribute wealth and help dampen property speculation.

Or we could adopt the German approach to capturing the value of changes in land use. When land is rezoned from, say, agricultural to residential in England and Australia, dramatic increases in land value generally accrue to the landowner. In Germany, much of this “planning gain” goes instead to public authorities and is used to fund infrastructure or social housing.

The complex relationship between housing demand and housing supply suggests there are no simple solutions to the challenges that we face, and we should be wary of claims that the answer is just to build more dwellings. If high prices are the product of a speculative bubble rather than undersupply, then building more houses will cause a different set of problems.

Economist Ian Mulheirn from the Tony Blair Institute for Global Change points out that high real estate prices fuelled residential building booms in Spain, Ireland and parts of the United States in the first decade of the 2000s. When that boom went bust, it contributed to the global financial crisis and left “a large overhang of vacant and decaying ghost estates.”

The “build more” argument often goes with the view that the supply of new houses is held back by planning and zoning “red tape.” It then becomes an argument for scrapping the rules that limit incursions into land set aside for other purposes, such as London’s green belt or Melbourne’s green wedges.

This is contested territory. Once developed, the environmental or agricultural benefits of that land are lost forever. But if green space effectively subsidises elite pursuits like “‘horseyculture’ and golf” then the case for turning some of it over to housing might carry more weight.

Planning has been the subject of persistent reform efforts in many parts of Australia without, as yet, delivering lower house prices. “Of right” approvals have been introduced for code-compliant projects, decision-making powers transferred from elected councils to expert panels, “special purpose” bodies created to deliver urban redevelopment, and ministers given greater powers to override local decisions on major projects.

Strong arguments exist for rules-based planning systems because the alternative of assessing each application individually is time-consuming and costly, especially if decisions are made at a hyperlocal rather than city-wide level. But planning regimes should align with environmental and social goals, including affordability, rather than simply empower developers to respond to a housing “demand” that may be driven by growing inequality.

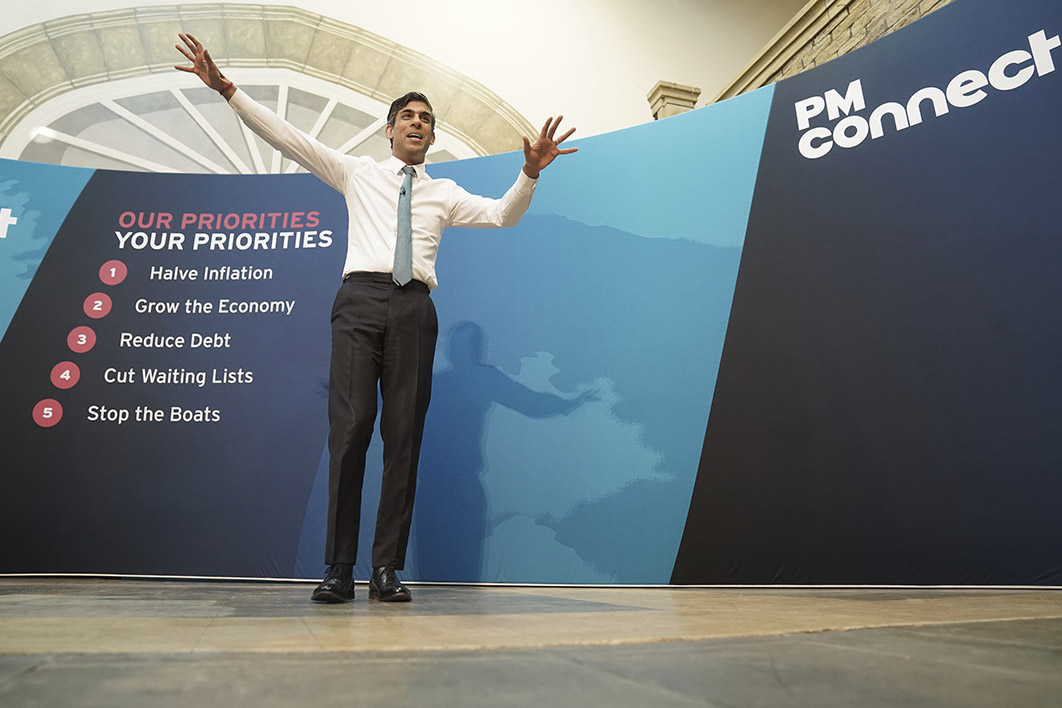

Treasurer Jim Chalmers says the task ahead is not just to build more homes, but to build more “well-located” homes. Boris Johnson’s one million homes promise was predicated on every local government area having its own mandatory housing target, although councils were very critical of the algorithm used to determine what to build where. Those targets have since been scrapped anyway, following opposition from Conservative MPs who feared a backlash against new developments in their prosperous constituencies.

This is a reminder that building homes where they are most needed — that is, with good access to jobs, transport and services — tends to throw up the biggest challenges.

In cities like Melbourne, this could be done by replacing postwar family homes with smaller, more energy-efficient, medium-density apartments and townhouses to better accommodate today’s smaller households. But it is in exactly these suburbs that not-in-my-backyard opposition tends to be most intense.

It is also in these areas that commercial barriers are greatest. It is easier to build on a rezoned greenfield site on the edge of the city, or in a rezoned brownfield area like a former dockland, than to transform a middle-ring greyfield area, especially if the aim is to retain the benefits of suburban streetscapes like tree canopies and gardens.

In such cases, what is needed is not so much liberalised planning, as consistent and supportive planning to assist developers to consolidate individual house blocks into larger sites, while also responding to community concerns about loss of amenity.

The number of dwellings is clearly important for the affordability and availability of housing, whether to buy or rent. But along with supply we also need to think about distribution, both spatial and economic. The question is not “do we need more houses” but rather “where do we need more houses, and who needs them most?”

To put this another way, is the challenge to keep up with housing demand, or to respond to housing need?

If it is the former, then the market is likely to meet the demand for a new holiday home more quickly than it meets the need of a low-income family to move out of an overcrowded, overpriced and damp apartment. Property developers have no incentive to provide housing for people who cannot pay prevailing rents or prices. Either we need to help those households participate in the market by boosting their incomes, or we need to build homes they can afford.

Another thing that Australia and England have in common is a sustained fall in public investment in social housing. If governments in both countries had continued to subsidise social housing at the rates they did in the postwar decades, then many thousands more affordable houses would be available today.

Prime minister Rishi Sunak’s Conservative government has no chance of delivering Boris Johnson’s 2019 pledge of a million homes before next year’s election. Let’s hope that Jim Chalmers has more success in building a million “well-located” new homes in Australia, and that a decent share of those homes are affordable for the people who need them most. •