In mid 1985 Australia banned tax breaks for negative gearing, as part of a package of sweeping tax reforms. A year later, under the Reagan administration, the United States did the same – and also abolished tax breaks for capital gains.

After two years, the Hawke government wobbled under pressure from vested interests and restored the tax break for negative gearing. But the United States has never restored it. If we want to know what might happen if Labor removes it again, the American experience has valuable lessons.

The motivation was similar. Tax breaks for capital gains and what Americans call “passive investment losses” (negative gearing) were widely seen as tax loopholes for the rich. At astonishing speed, a bipartisan political swell developed in 1986 for a sweeping trade-off that would close such loopholes and use the revenue saved to slash tax rates, especially for people on middle incomes. It became a kind of political tornado that swept through Washington: no interest group could stand in its way, and by the time it had passed, the US tax system had been revolutionised.

There, as here, there were predictions of doom. A pair of accountants from the University of Nevada forecast that rents would have to rise 28 per cent to allow investors to maintain their after-tax earnings. As late as 1990, renowned housing economist James Poterba of the Massachusetts Institute of Technology forecast that the change would drive up long-term rents by 10 to 15 per cent.

“The majority of policy analysts… viewed the reform as anti-housing,” Poterba explained in a 1994 retrospective for a conference of the Federal Reserve. “There was little doubt that the reforms would reduce incentives for rental housing construction… Many studies pointed out that the long-term stock of rental housing would decline as a consequence of the tax reform.” The result, they predicted, would be higher real rents.

Reality didn’t follow the script. Even as Poterba made his prediction in 1990, rents in the US were falling. And they were falling despite new apartment construction slumping by two-thirds, a crash even more intense than the industry had forecast. What had happened?

It’s a story we should remember when we see any forecasts of what will happen if Labor is elected and implements its tax reforms. Essentially, the impact of the 1986 US tax reforms was overrun by bigger forces. It would be the same here. The impact of Labor’s plans would be just one in a mix of forces that would shape future house prices, rent levels, home ownership rates and the rest.

In the US, the reforms coincided with three things: the bursting of the apartment building boom of the early-to-mid 1980s, which created rental vacancy rates of more than 10 per cent; the arrival of low inflation, which reduced the value of the tax breaks anyway; and the 1990–91 recession, which drove down demand for housing.

Not that Labor’s proposals are identical to the US reforms. There, investors were focused largely on apartment construction; in Australia, 93 per cent of money lent to investors is used to buy existing homes – and Labor plans to retain negative gearing for construction of new rental housing.

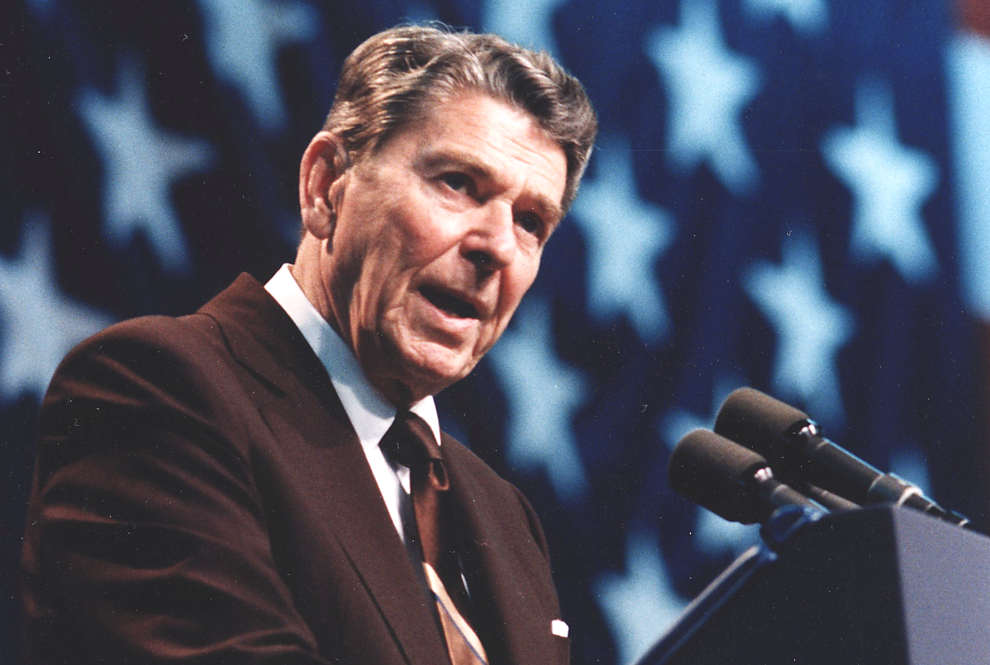

The US reforms went further than Labor has, phasing out tax breaks for existing negatively geared investments. Commenting on Poterba’s paper, Reagan’s former chief economic advisor, Martin Feldstein, blamed part of the apartment construction slump on this “retroactive” legislation, and said the reforms should have been aimed at future investments only – advice Labor has followed in drafting its plans.

But while the industry blamed the tax reforms for the slump in apartment construction, Poterba and Feldstein agreed that there were bigger factors at work. “Vacancy rates above 10 per cent were unprecedented in this market,” Poterba said. “A savvy analyst would have predicted in early 1986 that new construction would decline even without changes in tax provisions.” Feldstein concurred: “The excess building would probably have caused a glut by the late 1980s, leading to falling asset values and declining rents.” And that is exactly what happened.

Bear that in mind. In Australia during 2015, work began on 105,797 new units and apartments, almost double the highest number recorded in any previous boom. The signs of a glut that will force down prices in Sydney and Melbourne are already evident. In four years, the Bureau of Statistics tells us, prices for established houses rose 61 per cent in Sydney and 34 per cent in Melbourne, while per capita household income rose just 10 per cent. Both cities often experience sustained price falls, and they are almost certainly heading into another one now – whether the negative gearing rules are changed or not.

House prices did fall after the 1986 US reforms, Poterba reported, but only by an average of 1 per cent a year. Other factors were clearly at play, and once the US came out of the 1990–91 recession prices resumed their upward path. Real rents stabilised in the late 80s, then fell due to the glut of vacant homes. As the glut was worked off, they began rising again, but not dramatically. From 1994 to 2012, rents rose just under 3 per cent a year, while consumer prices averaged growth of 2.5 per cent. Falling prices of computers and audiovisual equipment explained the difference, not surging rents.

One other important difference must be mentioned. The efforts to close the US loopholes created their own loophole. Because they targeted only “passive investment losses,” they allowed rental losses made by “active investors” – those who manage their own property portfolio – to continue to be written off against tax. A 2012 paper by Larry Ozanne of the Congressional Budget Office notes that in 2006, 60 per cent of taxpayers reporting losses on rental investment wrote them off against income from other sources.

In all, the US experience suggests that the forecasts of the impact of the reforms added up to much ado about nothing. Their impact on real world activity was minor, and in some areas undetectable.

The same might be said of Australia’s experience when negative gearing deductions were abolished from 1985 to 1987. Saul Eslake has won the debate over what happened to rents: there was a marked rise in rents in Sydney and Perth, but it was a result of extremely tight vacancy rates, and would have happened anyway.

Yet just as that myth has been dispelled, a new one has been created this week by Louis Christopher of SQM Research in his critique of Labor’s reform plans. The headlines focused on his forecasts of falls of between 4 and 15 per cent in house prices, and up to 20 per cent in real estate turnover. But no one has highlighted the clear flaws in how he reached those conclusions.

Christopher looks for guidance to what happened in 1985–87, when Australia saw a marked slump in housing construction and sales. He assumes that all the damage was done by the government’s scrapping tax breaks for negative gearing – and takes that as his guide to what would happen if Labor did it in 2017.

Whoa, boy. Louis, are you really unaware of what happened to home mortgage rates in that time? In 1985 they were still regulated, and the Reserve Bank hiked them from 11.5 per cent to 13.5 per cent to try to slow down activity. That worked a treat in reducing lending to owner-occupiers. Then, in April 1986, the government deregulated mortgage rates, and the banks immediately hiked them to 15.5 per cent. That does tend to have an impact on housing activity. But Christopher’s analysis fails to mention it.

Nor does he mention the home lending data. It shows that, far from activity falling because “buyers ultimately lost interest in non-negatively geared properties,” as he claims, lending to investors buying existing homes in fact rose slightly as a share of home lending during the period in which negative gearing was banned! Tax Office data also shows that in 1986–87 the number of rental investors rose by 6000. It wasn’t the investors who toppled the market.

Rather, the housing slump Christopher ascribes to the abolition of tax breaks for negative gearing was primarily due to a combination of the interest rate rise to 15.5 per cent, the bust of the 1984–85 construction boom, and the economy hitting a speed hump as the Reserve pushed up interest rates generally. Trend unemployment rose by 55,000 or 0.5 per cent. New car registrations slumped by 26 per cent, from 511,000 to 376,000. You’re surely not going to blame that on the end of tax breaks for negative gearing?

That is not to say that his forecasts are necessarily wrong. I don’t know what would happen either, but the conclusion that Labor’s reforms could slice 4 per cent off future growth in house prices, as forecast at the lower end of his projections and in a separate report this week from Gene Tunny of Adept Economics, sounds in the right ball park to me.

Tunny’s report was prepared for Brisbane firm Walshs Financial Planning, whose website says it provides “accounting and taxation services to high net worth individuals (including medical practitioners), family businesses and other small-medium enterprises (SMEs).” Fair enough: they’ve got a vested interest in this, and they don’t hide it. While the report is clearly tailored for the development industry and makes many debatable claims, its estimate that Labor’s reforms would cut $20,000 from the future value of a $500,000 home seems to me a reasonable guess.

But that is, after all, the main point of the reform: it aims to make housing more affordable by restraining future growth in house prices. There would be benefits to the budget too, but Adept argues persuasively that they would be relatively minor and develop only slowly. It also makes a case that Labor’s plan to cut the capital gains tax break from 50 per cent to 25 per cent goes too far, and that 40 per cent would be a better target.

It argues less convincingly that lifting housing supply would be a better way to make housing more affordable. That is a cliché in this Sydneycentric industry, which ignores the fact that Melbourne has zoned vast amounts of land for development but has similar problems with affordability.

The fact is that you can only make housing more affordable in a sustained way by reducing the future growth in prices. Suppose you raise housing supply: how will that have an impact on affordability? By bringing down prices – or at least, as Tunny rightly puts it, growth in house prices. The record housing supply we’ve had in the past year will reduce growth in prices. But if you’re serious about making housing more affordable, it’s not an either/or issue. There’s no reason why you can’t tackle both negative gearing and land supply issues.

Since negative gearing was restored in 1987, Australia has had three decades of extreme inflation in the housing market. In that time, the average price of an established home in our cities has risen by 727 per cent. Household debt has soared from 60 per cent of household income to 186 per cent. The tax break for negative gearing diverts investment into existing housing, where it simply inflates prices and prices poorer families out of the market. It is inequitable, and it is not a sustainable basis for economic growth.

Sadly, inflation does not make us any richer. In housing, we buy in the same market that we sell. Unless we are downsizing or moving somewhere cheaper, our increased “wealth” from rising property prices is an illusion.

In my judgement, Labor’s tax reforms are the most important policy package either side has put forward in this campaign. They are carefully crafted to avoid creating a “rush for the exits” by investors. They would gradually restore housing affordability, and restore home ownership – which was a key policy objective of the Liberal Party in the Menzies era.

Malcolm Turnbull clearly understood the problems with negative gearing when he was writing his 2005 tax paper, and in the work he and Scott Morrison did last summer – before Labor announced its plans and the Coalition decided, for opportunistic reasons, to oppose any reform. I have not given up hope that if Turnbull wins the election he will reclaim that Menzies legacy and work for a bipartisan reform to make it happen. •