“We are like a small sesame seed, stuck in the middle of conflict between two great powers.”

— Huawei founder Ren Zhengfei, 16 January 2019

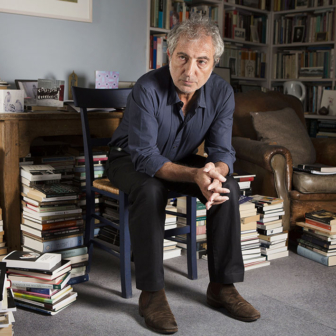

The founder of Huawei, one of the handful of companies that underpin today’s global telecommunications systems, has achieved a great deal by staying within the boundaries of politics. He also likes to keep a low profile.

It wasn’t until January 2019 that Ren Zhengfei gave his first press conference to international media, about six weeks after his daughter, Meng Wanzhou, was detained in Canada at the request of US authorities. The Americans later sought her extradition on charges related to alleged breaches of US sanctions on Iran.

Meng ultimately returned to China in September 2021 after agreeing to a plea deal. In the meantime, Huawei had been thrust into centre stage by rising US-led resistance to China’s trade policies. Australia banned Huawei — and another Chinese company, ZTE — from its 5G telecommunications network in August 2018. The US banned Huawei in May 2019. Britain, which had allowed the company to participate in its 5G rollout, ordered Huawei equipment removed in July 2020. Over time, the American focus on Huawei caused many other countries to reverse or avoid the likely use of its technology in their networks.

A vigorous effort to inhibit China’s emerging technology industry was part of Donald Trump’s first-term tariff gambit. The Biden administration tightened the focus to limit the flow of advanced technologies, notably semiconductors and the equipment used to make them. As the second Trump presidency imposes higher tariffs, China has responded again with tariffs on US exports.

In House of Huawei, Washington Post reporter Eva Dou puts together a credible picture of Ren’s progress from his birth in 1944 into a family disposed to both education and innovation, showing how he avoided the potentially dire consequences of his family’s prior privileged status when the Red Guards took control at his university, and how an engineering role in the military opened the way for his entrepreneurial character to bring opportunities in the post-Mao environment.

Mao Zedong’s death in 1976 led eventually to Deng Xiaoping and other reformers, and to fundamental policy changes. The military engineering corps, where Ren had achieved prominence, was disbanded in 1982. A trade-exposed zone was created adjacent to Hongkong in Shenzhen, where Ren was now living. Farmers were allowed to join in collective private activity using a structure Ren adopted to make his private company legal. That company, Huawei, was established in 1987.

Although his mysterious private company, distinct from China’s many state enterprises, has been the target of policy around the world, it seems likely that Chinese technology as a whole drives American prejudices. Dou makes it plain that Huawei is solidly Chinese and that Ren has been careful to maintain a corporate ethos that aligns closely with Beijing’s idea of a solid corporate citizen. Her evidence also suggests that Huawei succeeded because it delivered indigenous technologies when Beijing needed them, and that it grew by shrewdly interpreting China’s financial and political systems.

Dou shows that Ren was able to attract early financing by aligning with political interests and showing evidence of success. But when the state banks offered growth funding, he avoided the option that involved Huawei’s absorption into the state sector. Over time, the organising structures of Huawei’s economic interests have evolved with its growth and changing regulation. But staff (including Ren and other founders) retain control, say Dou, in a structure that nevertheless has an apparently influential Communist Party council.

Huawei has done things that the United States would find unacceptable. It provided telecoms to Iran. It seems likely to have copied a US switch in making its first domestic product. Its technology is widely employed by China’s security institutions in various forms of surveillance. Its infrastructure has allegedly communicated data to China from foreign networks.

Dou shows that US and other security services also make elaborate use of public telecommunications intrusions. The Snowden leaks revealed that the NSA had even tapped into Huawei itself, and in other cases monitored high-capacity intercontinental data cables. (She could also have mentioned the embarrassing revelation that Australia tapped into cellphone of the wife an Indonesian president.)

Trump’s first-term national security adviser, John Bolton, argued that 5G was more risky than past telecom infrastructure because it is “flat” (rather than deeply layered) and a single penetration can expose much more of the system. But British authorities had created a secure testing centre managed by their peak security agency, the GCHQ, solely to ensure that Huawei equipment didn’t pose a risk. When the Americans demanded their ally toe the line, the British pushed back, asking why — of all the things it might worry about — the United States was focused on a few British base stations. According to Dou, Bolton replied, “You gotta pick something.”

Despite serious curbs on its global ambitions, Huawei generates revenue of more than US$100 billion and is highly profitable. Having begun as a virtually anonymous network switch-maker, it has diversified into face-recognition software, solar panels, electric vehicles, autonomous vehicle technologies, smartphones and consumer IT. In many ways, it is still the sesame seed Ren described in 2019 — but while it has lost as much as a quarter of its revenue since trade tensions grew, it remains a vital player in China.

On 17 February this year Xi Jinping held a forum with private business figures — only the fourth such meeting held by the Chinese president. The event was notable for the public recognition of Jack Ma, the founder of the e-commerce giant Alibaba, who had been put in Xi’s deep freeze in evident response to Ma’s boldness in public. But it was Ren Zhengfei who seemed to grab the most attention. Huawei had surprised the global IT world in 2023 when it produced a 5G smartphone with a Huawei semiconductor; at the meeting in February Ren reportedly assured Xi that China was capable of technological independence, and specifically that it could make advanced chips for AI and other strategic purposes.

The two superpower antagonists, China and the United States, each face foundational political risks. China’s system is wedded to the pre-eminence of the Communist Party. The United States is testing its division of executive, congressional and the courts. Politically, Xi has elevated even further the primacy of state enterprises and appears to be trying to resuscitate the private entrepreneurial energies that have driven much of China’s progress. Trump appears to believe in sharply reducing US trade exposure and relying instead on attracting innovators to its market.

The already evident risk of these behaviours is that innovation and technological evolution are likely slow down as companies like Huawei invest in making the chips that only Taiwan’s TSMC can currently make, and TSMC diverts its efforts to put a US$100 billion plant on American soil to satisfy Trump. Another outcome, evident across many sectors, is excess: with tariffs and other trade barriers promoting duplication, markets are being flooded with too much production of too many goods.

It is noticeable that both China and the United States have a political focus on technology. Xi’s strategy relies to a substantial extent on innovations that drive productivity. China needs higher-value outcomes to advance beyond “middle income” status and Xi is promoting heavy investment across a range of areas.

Trump, on the other hand, has had the support of a number of technology businesses — but most of them (Amazon, Meta, Alphabet, Tesla) are likely to be motivated by rising concern among voters about their market dominance, which was being scrutinised by the Biden administration and has also been criticised by people such as J.D. Vance. Trump seems more likely to reduce funding for research and innovation and has already targeted the Chips Act and the Inflation Reduction Act, which funded Biden’s cornerstone innovation programs.

Given the evident social influence of technology and the presumed transformation we face through artificial intelligence, 5G, robotics and a range of related applications, the US–China split over technology is likely to have profound impacts.

House of Huawei is a rich catalogue of insights into a company that might exemplify China’s future — a loyal Chinese organisation with a sharp focus on innovation. Eve Dou also revealed valuable and interesting aspects of the otherwise hidden story behind Huawei’s founding, and of its reclusive founder. •

House of Huawei: Inside the Secret World of China’s Most Powerful Company

By Eve Dou | Little, Brown | $34.99 | 448 pages