“Change the prime minister, and you change the country.” Paul Keating’s words resonate when you look at how Australia has changed in the past twenty-five years. In 1996 we threw out his government — and in doing so, largely ended a period of bold social and economic reforms aimed at making the country more competitive without sacrificing fairness.

Prime minister Bob Hawke and Keating, his treasurer and successor, won support for tough reforms — holding down wages and instead giving workers universal healthcare and superannuation, subjecting once-universal welfare benefits to income and asset tests — because Australians felt themselves to be economically vulnerable. Being a big agricultural exporter was no longer a ticket to wealth. The elites of left and right agreed: we had to reform, work harder, change our game.

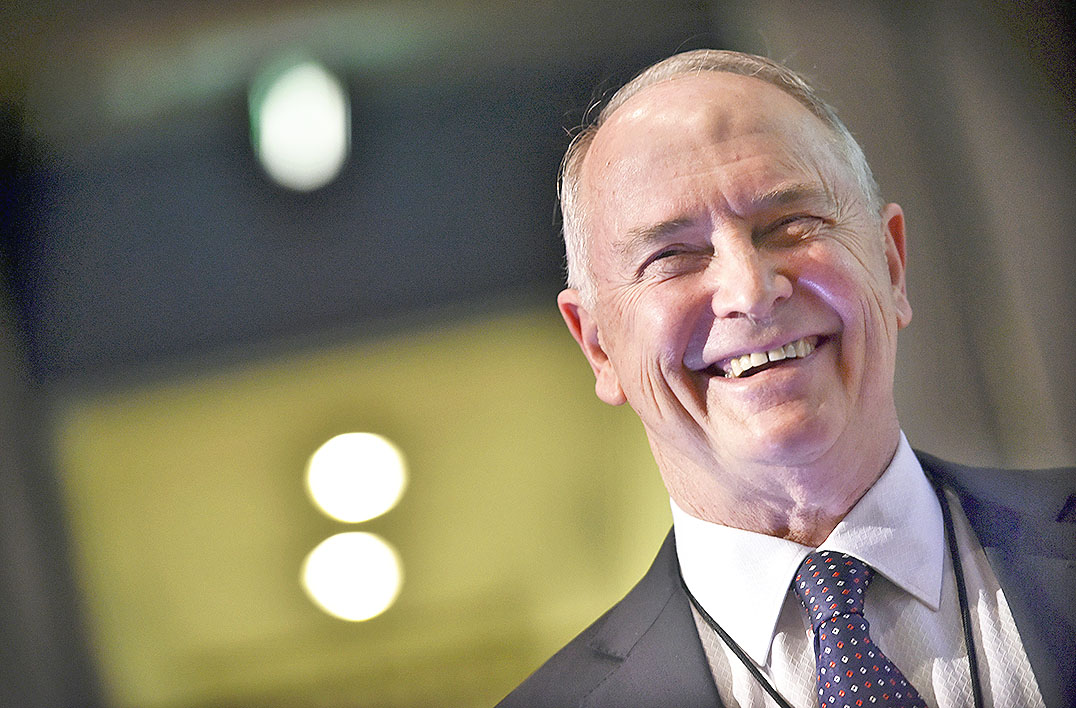

Ross Garnaut was at the forefront of that reform surge. He was Hawke’s economic adviser, then Australian ambassador to China and, from a prestigious base at the Australian National University, an influential advocate for free trade and enmeshing Australia in the Asia-Pacific. His 1989 report advocating scrapping tariff protection for manufacturing to make other industries more globally competitive was crucial to the government’s decision to do just that, which saw 130,000 manufacturing jobs wiped out.

At the 1996 election, John Howard swept Keating away, pledging to make Australians “relaxed and comfortable.” He led one last big reform, the introduction of the GST, and that was it. Reform gave way to media management, giveaways to voters, culture wars designed to wedge opponents, and help for vested interests. In this century the only big economic reform worth the name came when the crossbenches forced the Gillard government to adopt a carbon price, which the Coalition then scrapped on coming to office.

Garnaut played a key role in that reform too, after Kevin Rudd (one of his junior diplomats in Beijing days) asked him to write a report weighing up Australia’s climate change options and Julia Gillard brought him into the final negotiations on how to make a carbon price work. But the return of the Coalition in 2013 saw him back on the outer, as any prospect of serious economic reform disappeared.

While Bill Shorten’s period as leader raised hopes that Labor in government could renew its zeal for reform, a government led by Anthony Albanese looks no more likely to take tough decisions than a Coalition one. Those who see urgent need for reforms seem to be talking to ourselves; those able to do anything about them are simply not interested.

Ross Garnaut is undeterred. His new book, Reset: Restoring Australia after the Pandemic Recession, is a wide-ranging almanac of reform proposals to give Australia a better future: on economic, social and environmental fronts. At times, he seems to be talking directly to the Morrison government, as if hoping that it has Australia’s long-term interests at heart, despite evidence to the contrary, and could be persuaded to embark on politically difficult reforms to secure them.

Appeals to revive the spirit of the Hawke–Keating government under this government frankly seem like a waste of breath. But it is the fate of reformers to debate reform options in their own minds and with those they respect, and Garnaut’s book is full of them, all focused on creating an Australia with full employment — as soon as possible — rising standards of living, sustainable finances, and world-leading new industries based on renewable energy.

Most of the media coverage of the book has focused on Garnaut’s proposals for macroeconomic reform: lifting the growth rate by reshaping and reducing taxes, and financing those changes by issuing new government bonds bought directly by the Reserve Bank. This would further increase the federal deficit, at least initially, and loosen monetary policy to levels comparable to other Western countries, leading indirectly to a lower Australian dollar, and a more competitive economy.

Restoring full employment by transforming our international competitiveness is one of the two key themes of the book. But the other is equally central: to achieve this will require business and government to rapidly develop Australia’s new international competitive advantage in renewable energy and the products dependent on it: the hydrogen economy, ammonia and fertilisers, metal refining, and downstream processing in products such as steel and aluminium.

The macroeconomic agenda is the logical place to start. And for an economist known as a voice of orthodoxy, Garnaut’s proposals show how far that orthodoxy has moved since 2008.

He cuts through the spin we hear about Australia’s economic performance in the past decade, in what Garnaut likes to call the “Dog Days.” As I too have argued, it was unimpressive, whether compared with our past experience or with our international peers. Unemployment stalled above 5 per cent, underemployment swelled, real wages stagnated as never before, and GDP growth rates looked okay only because they were inflated by high immigration.

Without a policy reset, Garnaut argues, that past is what Australia risks going back to as we emerge from this recession. He gives the government high marks for dropping its deficit fetish after Covid-19 struck, when it successfully pumped money into households and business to stimulate spending. But like other economists, he argues it switched its focus too quickly to reining in future deficits when the bigger job is to get people back to work.

He boldly, and rightly, assails the misuse by the Reserve Bank, Treasury and others of the concept of the NAIRU (the “non-accelerating inflation rate of unemployment”), an estimate of how low unemployment can fall without causing rising inflation. The NAIRU makes good theoretical sense but in reality is impossible to calculate accurately when no such events happen. In 2012 the US Federal Reserve estimated the limit for the United States was 5.5 per cent. Yet by 2019 unemployment was 3.5 per cent and inflation almost non-existent.

Except for Western Australia during the labour shortage of the first resources boom, wage growth has not driven up inflation in Australia since the 1980s. Treasury’s estimate of the NAIRU as 5 per cent, and the Reserve Bank’s estimate of “4-point-something” are equally phoney. As Garnaut says, “We simply don’t know, and we won’t know until unemployment falls to a level at which wages rise at an accelerating rate.” He suggests aiming for a 3.5 per cent unemployment rate, and then lower unless inflation is “accelerating dangerously out of the top of the Reserve Bank’s target range.”

To get to 3.5 per cent unemployment by 2025, he estimates that Australia needs to create 1.2 million new jobs in just four years. That is a huge task, considering the headwinds we face: “the huge legacy of public debt, a smaller capital stock per person (because of low business investment)… major losses in export industries… reduced productivity… the effects of climate change, an ageing population… [and] lower population and workforce growth.”

Garnaut makes a second bold but correct call: don’t return to high immigration levels. In the past decade or two, net overseas migration has averaged 1 per cent of the nation’s population every year, mostly from people coming (or staying on) here to work, and taking jobs that in the past went to school leavers or graduates, whether in service stations or in IT and the like.

I have written about this several times. Between 2008 and 2016, roughly three-quarters of all net growth in full-time jobs went to new migrants. Of the 474,000 full-time jobs added in that time, only 74,000 went to workers born in Australia, while 168,000 went to workers born on the Indian subcontinent. Treasury looked at a different set of years and found similar numbers.

“Immigration now lowers the incomes and employment prospects of low-income Australians,” Garnaut concludes. “Integration into a global labour market [has]… contributed to persistent unemployment, rising underemployment… stagnant real wages [and]… a historic shift in the distribution of income from wages to profits.” Temporary worker migration in reality is not focused on solving skill shortages, as promised, and migrant workers are frequently exploited, as Age journalist Adele Ferguson has shown.

Garnaut argues for halving the annual net immigration rate to 0.5 per cent: in round figures, 125,000 a year rather than 250,000. Of all his reform proposals, it is one of the most viable politically.

To create those 1.2 million jobs by 2025, both fiscal and monetary policy must be set unambiguously to expansion. The Reserve Bank, Garnaut says, needs to accelerate as hard as most other central banks in the West are doing to bring the dollar down and make Australian producers more competitive. (He notes that Australia might still be making cars had the Reserve understood the damage it was doing to our competitiveness by failing to halt the dollar’s rise during the resources boom. In the new age of electric vehicles, there is no one left here to make them.)

I would add one caution, however. We can’t ask the Reserve to correct the damage from bad government policies: only governments can do that, and none of our recent governments has wanted to. So low interest rates once again are igniting an explosion of tax-driven investment in rental property that will deprive growing numbers of Australians of the chance to own their own home, perhaps forever.

On budget policy, Garnaut empathises with the Coalition’s desire to start reducing the deficit to minimise the debt it will bequeath to future governments — but concludes that this is not the time for it. The government, like the Reserve, should still have its foot on the accelerator, not the brake, and he has two big ideas on how to go about it:

• The complex tax and welfare system should be simplified to (mostly) one flat tax rate and one big welfare payment. The payment would be what is variously called a universal basic income or negative income tax — Garnaut prefers to call it the Australian Income Security, or AIS — which would guarantee all Australian citizens (except those too rich to qualify) a tax-free payment of about $15,000 a year, topped up with further payments for those who are aged, disabled, unemployed or parents with dependent children.

Conversely, all income from the first dollar would be taxed at the rate of 37 per cent up to $180,000, and 45 per cent above that. The combination of the AIS and the tax would make this more egalitarian than it might appear. Garnaut argues that it would provide a stronger welfare net, provide greater incentive to work, simplify tax and welfare administration, and provide an immediate (but temporary) boost to demand.

• Business taxation would no longer be levied on profits, but on cashflow. This would make all investment spending immediately deductible against tax, providing a permanent incentive to higher investment. But interest payments and financing costs would no longer be deductible, except for banks and financial firms, and payments overseas for royalties, marketing and management fees would be deductible only if they were incurred directly in producing the firm’s output.

Conversely, however, companies with a negative cashflow would receive a cash credit, effectively paid for by other taxpayers. For those other taxpayers, that is a risky part of the design. A similar promise of a blank cheque for losses was one factor in the downfall of the Rudd government’s mining tax in 2010.

Garnaut argues that a cashflow tax would provide an incentive to investment, especially on risky projects. (BHP’s plan to build a fast rail line between Melbourne and Sydney in the early 1990s fell over when the Keating government declined to give it such tax treatment.) He also claims that removing deductions for interest payments and payments for imported intellectual property (often to a related company) would remove “the main opportunities for corporate tax avoidance and evasion.”

It’s an idea that’s been around a long time without any country adopting it. The Republicans in Washington flirted with a version of it a few years ago, but Donald Trump killed that idea.

• Garnaut also raises a third suggestion that is much easier to implement and could provide the right sort of stimulus: dump the convention that requires cost–benefit studies of infrastructure projects to use a discount rate of 7 per cent per annum above inflation to estimate the future value of projects in today’s dollars. At one time, that vaguely matched reality, but it was long ago. In an age of minimal interest rates, the convention is inaccurate, unscientific and harmful to good decision-making.

Frankly, it seems unlikely that any Australian government will implement either of Garnaut’s two big tax and welfare reforms in the near term. The Morrison government’s derisory cup-of-coffee-a-day increase to Newstart despite widespread bipartisan support for real reform shows its aversion to tackling the hard work of economic restructuring. Anthony Albanese seems to want people to like him, above all, and thus to avoid conflict — which unfortunately is an inevitable by-product of reform.

In Garnaut’s view, the Australian economy is facing so many headwinds that business as usual will not generate the jobs required to restore full employment. We need to try a new tack: to rephrase Ken Henry’s famous advice to the Rudd government: “Go hard, go early, go renewables.”

As he spelt out in his 2019 book Superpower: Australia’s Low-Carbon Opportunity, Garnaut sees Australia’s vast land mass and solar radiation as a resource that no other country can match in the dawning age of renewable energy. Just as our coal and gas resources gave us a huge competitive advantage until we began pricing them at global parity, we can produce solar and wind energy more cheaply and plentifully than any comparable country. This could become our leading export industry of the future, as coal exports diminish and gas exports flatline. In his words:

There is no comparable opportunity for profitable expansion of business investment in other trade-exposed industries. Getting carbon right becomes an integral part of getting economic policy right.

The transformation should begin on a large scale now… It is feasible now to replace most of Australia’s large imports of ammonia-based products (such as fertilisers). Building supply from new plants in rural and provincial Australia that rely on renewable energy and hydrogen — at prices competitive with high-emission alternatives — can happen in time to contribute to full employment in 2025.

Zero-emissions electricity at prices within the range required to keep established mainland aluminium smelters alive is possible now. By contrast, aluminium smelting at Gladstone, Newcastle and Portland would not survive through the 2020s with continuous coal-based power supply.

[With budget subsidies]… the first commercial-scale hydrogen-based iron-making plant can be built as part of the movement to full employment. Make a start on commercial-scale plants, and more business investment will follow.

In Garnaut’s view, the hydrogen economy is not for the distant future, it is something we should start creating now. British billionaire Sanjeev Gupta, with whom he has worked, last month launched a feasibility study for an industrial-scale hydrogen-fuelled steel plant at Dunkirk. Three separate consortia are progressing plans to build renewables-powered hydrogen plants in the Pilbara to supply domestic and Asian markets. He sees traditional coal and gas centres like Gladstone becoming centres of hydrogen production and metal refining using renewable energy.

Not all agree. The day Garnaut’s book was released, BlueScope’s chief executive, Mark Vassella, said it plans to use old technology to update its Port Kembla steelworks, warning that “green steel” might not become mainstream for another twenty years.

But many of Australia’s heavy industrial plants will not last that long. And as the laggard of the Western world in reducing greenhouse emissions from industry, Australia now faces the prospect of tariffs in Europe and North America to force it to speed up its transition.

Garnaut argues that green steel, green aluminium and green fertilisers will command premium prices in the renewable era. Australia should be a first mover in using its wind and solar resources to produce them.

He is practical, not religious, in his outlook. Unlike the green lobby, he sees gas playing a prominent role in Australia’s future, backed by carbon capture and storage in areas where that is geologically feasible. But renewables, not gas, are the main game — and our economic flagship of the future.

One subject that appears rarely in this book is China. When Garnaut has been one of Australia’s foremost experts on China for almost four decades, that is surprising, but also a sign that we live in dangerous times.

When he does touch on China, he is careful but clear-eyed. He advises Australian firms to look to develop other markets, especially in Southeast Asia, and warns that ultimately China will look for other sources of iron ore, and of so much else that it once bought from us.

The one passage in which he does address Sino-Australian relations directly is, in my opinion, worth thinking carefully about:

There does not seem to be any early prospect of the restrictions in Sino-Australian trade lifting to leave clear air. There are real issues of Australian security to be managed. There are real Chinese responses to Australian initiatives. Australia and China will respond from time to time in ways that are influenced by the shifting dynamics of US politics and international engagement.

What might be possible is a narrowing of restriction to the minimum necessary for meeting clearly defined and essential security interests, as analysis and the passing of time causes us to see them. This will make heavy demands on Australian knowledge and analysis. It will take subtle and intense diplomacy.

It will require Australians to adjust to the realities of living in a perilous world, in which peace and prosperity, and our effective sovereignty, depend on understanding the world as it is and not as we wish it to be.

This is a world that has been inhabited by other countries of modest size alongside great powers since the beginning of the nation state. It is a world that is understood from history by our Western Pacific neighbours South Korea, Vietnam and Thailand — and by the neighbours of great powers in Europe and Central and North America.

There is pain and wisdom in these words. •

The publication of this article was supported by a grant from the Judith Neilson Institute for Journalism and Ideas.